We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards AvalonBay Communities Inc (NYSE:AVB).

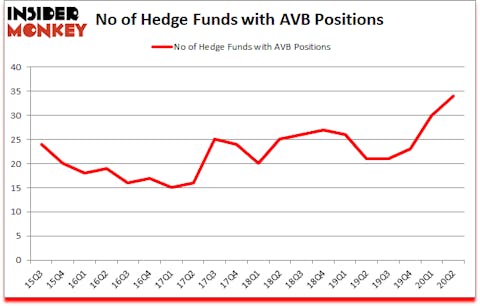

AvalonBay Communities Inc (NYSE:AVB) has experienced an increase in enthusiasm from smart money lately. AvalonBay Communities Inc (NYSE:AVB) was in 34 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 30. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 30 hedge funds in our database with AVB holdings at the end of March. Our calculations also showed that AVB isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most traders, hedge funds are viewed as worthless, old financial tools of years past. While there are greater than 8000 funds with their doors open today, Our researchers look at the upper echelon of this club, about 850 funds. Most estimates calculate that this group of people manage the lion’s share of the smart money’s total asset base, and by following their finest stock picks, Insider Monkey has deciphered several investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 34% since February 2017 (through August 17th) even though the market was up 53% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Last week, most investors overlooked a major development because of the presidential elections: Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 best high dividend stocks to buy to identify high dividend stocks with upside potential in this low interest rate environment. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Keeping this in mind let’s analyze the new hedge fund action encompassing AvalonBay Communities Inc (NYSE:AVB).

What does smart money think about AvalonBay Communities Inc (NYSE:AVB)?

At Q2’s end, a total of 34 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the first quarter of 2020. By comparison, 21 hedge funds held shares or bullish call options in AVB a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, D1 Capital Partners held the most valuable stake in AvalonBay Communities Inc (NYSE:AVB), which was worth $543 million at the end of the third quarter. On the second spot was Echo Street Capital Management which amassed $167.6 million worth of shares. Long Pond Capital, Renaissance Technologies, and AQR Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Long Pond Capital allocated the biggest weight to AvalonBay Communities Inc (NYSE:AVB), around 5.39% of its 13F portfolio. Centerbridge Partners is also relatively very bullish on the stock, earmarking 4.96 percent of its 13F equity portfolio to AVB.

With a general bullishness amongst the heavyweights, key hedge funds were breaking ground themselves. D1 Capital Partners, managed by Daniel Sundheim, established the most valuable position in AvalonBay Communities Inc (NYSE:AVB). D1 Capital Partners had $543 million invested in the company at the end of the quarter. Brian J. Higgins’s King Street Capital also made a $23.5 million investment in the stock during the quarter. The other funds with brand new AVB positions are Mark T. Gallogly’s Centerbridge Partners, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Chen Tianqiao’s Shanda Asset Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as AvalonBay Communities Inc (NYSE:AVB) but similarly valued. We will take a look at Tyson Foods, Inc. (NYSE:TSN), Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk (NYSE:TLK), CrowdStrike Holdings, Inc. (NASDAQ:CRWD), Align Technology, Inc. (NASDAQ:ALGN), Welltower Inc. (NYSE:WELL), Sun Life Financial Inc. (NYSE:SLF), and Stanley Black & Decker, Inc. (NYSE:SWK). All of these stocks’ market caps are closest to AVB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TSN | 37 | 649082 | -4 |

| TLK | 4 | 166226 | -3 |

| CRWD | 78 | 3277716 | 13 |

| ALGN | 41 | 1960739 | 2 |

| WELL | 27 | 655260 | 2 |

| SLF | 14 | 85306 | -2 |

| SWK | 33 | 807322 | -3 |

| Average | 33.4 | 1085950 | 0.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.4 hedge funds with bullish positions and the average amount invested in these stocks was $1086 million. That figure was $1283 million in AVB’s case. CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is the most popular stock in this table. On the other hand Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk (NYSE:TLK) is the least popular one with only 4 bullish hedge fund positions. AvalonBay Communities Inc (NYSE:AVB) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for AVB is 59.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and beat the market again by 20.1 percentage points. Unfortunately AVB wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on AVB were disappointed as the stock returned -9.1% since the end of June (through 10/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Avalonbay Communities Inc (NYSE:AVB)

Follow Avalonbay Communities Inc (NYSE:AVB)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.