Omega Advisors is a Florida-based investment firm run by Leon Cooperman. The fund manages a $3.24 billion public equity portfolio as of September 30, down from $3.53 billion a quarter earlier. Nonetheless, its stock picks returned 12.53% in the third quarter when looking at its 12 long positions in companies having a market cap of at least $1 billion (we filter out micro-cap stocks as they are overly volatile). We believe that investors should pay attention to hedge funds’ top picks for a chance to beat the market like Cooperman’s stock picks did in Q3, so let’s have a look at its picks in Alphabet Inc (NASDAQ:GOOGL), Navient Corp (NASDAQ:NAVI), Ashland Inc. (NYSE:ASH), and Chimera Investment Corporation (NYSE:CIM) and see how they’ve performed.

Despite all of the negative sentiment looming around the $3 trillion hedge fund industry, the smart money logged positive returns for seven or eight consecutive months (depending on the source) before that streak came to an end in October. The third-quarter was a particularly strong one for the industry, as evidenced by our own data. 659 funds in our system which filed for the June 30 13F reporting period held long positions in at least 5 non-micro-cap stocks, and those funds’ long bets posted 8.3% gains in the third-quarter based on the size of their positions on June 30. That easily bested the performance of S&P 500 ETFs, which returned only 3.3% for the period. Where hedge funds tend to falter is on the other positions in their portfolios (options plays, bonds, etc.), which are there to limit downside risk, but also limit upside potential.

Omega Advisors unloaded 38% of its Alphabet Inc (NASDAQ:GOOGL) position in the third quarter, ending the period with 161,156 class A shares of the company, which had a value of $129.58 million at the end of September. The stock returned 14.3% during the third quarter. Alphabet Inc (NASDAQ:GOOGL) shareholders have witnessed a decrease in hedge fund sentiment lately. GOOGL was in 135 hedge funds’ portfolios at the end of June, down from 155 hedge funds in our database with GOOGL positions at the end of the previous quarter. Viking Global was the largest shareholder of Alphabet Inc (NASDAQ:GOOGL), with a stake worth $1.26 billion reported as of the end of June. Trailing Viking Global was Lansdowne Partners, which amassed a stake valued at $942.1 million. Fisher Asset Management, Generation Investment Management, and Eagle Capital Management also held valuable positions in the company.

Follow Alphabet Inc. (NASDAQ:GOOG)

Follow Alphabet Inc. (NASDAQ:GOOG)

Receive real-time insider trading and news alerts

Omega Advisors reported ownership of 11.32 million shares of Navient Corp (NASDAQ:NAVI) as of September 30, which means the fund sold 18% of its stake in the company during the September quarter. The total worth of the updated stake stood at $163.78 million on September 30. Cooperman may have been taking some profit from the position, as shares gained 22.4% during the third quarter. Navient Corp (NASDAQ:NAVI) was in 32 hedge funds’ portfolios at the end of the second quarter of 2016 out of those we follow, up from 27 hedge funds in our database with NAVI positions at the end of the previous quarter, so several hedge funds appear to have timed their entry into the stock well. Trailing Omega Advisors was D E Shaw, which amassed a stake valued at $70.3 million. Carlson Capital, Kingstown Capital Management, and Canyon Capital Advisors also held valuable positions in the company.

Follow Navient Corp (NASDAQ:NAVI)

Follow Navient Corp (NASDAQ:NAVI)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.

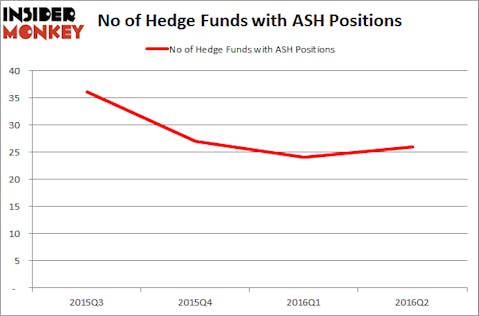

Omega Advisors sold 18% of its stake in Ashland Inc. (NYSE:ASH) in the third quarter, ending the period with 670,987 shares of the company valued at $77.80 million. The stock had a modest third-quarter, gaining 1.4% during that time. Heading into the third quarter of 2016, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, an 8% increase from the previous quarter. The largest stake in Ashland Inc. (NYSE:ASH) was held by Elmrox Investment Group, which reported holding $107.4 million worth of stock as of the end of June. Other investors bullish on the company included JANA Partners, Hitchwood Capital Management, and Miura Global Management.

Follow Ashland Llc (NYSE:ASH)

Follow Ashland Llc (NYSE:ASH)

Receive real-time insider trading and news alerts

Lastly, Omega Advisors continued getting rid of Chimera Investment Corporation (NYSE:CIM) in the third quarter as well, after selling 42% of its stake in the company in the second quarter. Cooperman’s fund sold another 47% of its stake in Chimera in the third quarter, as Chimera’s stock returned 4.6% in the three-month period ended September 30. Chimera Investment Corporation (NYSE:CIM) was in 13 hedge funds’ portfolios at the end of June among those in our database, up by one quarter-over-quarter. Two Sigma Advisors, Arrowstreet Capital, D E Shaw, and Raiff Partners were among those bullish on Chimera Investment Corporation (NYSE:CIM).

Follow Chimera Investment Corp (NYSE:CIM)

Follow Chimera Investment Corp (NYSE:CIM)

Receive real-time insider trading and news alerts

Disclosure: None