Goodnow Investment Group was founded by Edward Goodnow. The fund’s equity portfolio is worth $422.13 million as of the end of September, down from $429.40 million a quarter earlier, and is diversified across sectors. According to our calculations, the fund generated a third-quarter return of 10.77%, based on 21 long positions in companies worth over $1.0 billion.

Contrary to the actual returns of hedge funds which are taking it on the chin lately, long positions of the smart money always tend to beat the market. For instance, 95% of nearly 660 funds tracked by Insider Monkey collectively returned 8.3% in the third quarter from their long bets, dwarfing the S&P 500 ETF’s return of 3.3% for the period.

Having said that, let’s take a closer look at some of Goodnow’s top picks, particularly: Credit Acceptance Corp. (NASDAQ:CACC), Aircastle Limited (NYSE:AYR), Paypal Holdings Inc (NASDAQ:PYPL), and Commscope Holding Company Inc (NASDAQ:COMM).

Denys Prykhodov / Shutterstock.com

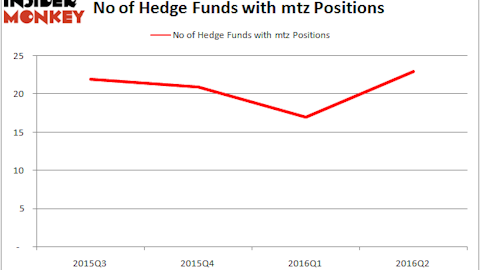

Goodnow Investment Group had 217,261 shares of Credit Acceptance Corp. (NASDAQ:CACC) worth $43.69 million at the end of September. The investment was fruitful as the stock returned 8.6% in the third quarter. During the second quarter, the number of funds from our database long Credit Acceptance Corp declined by two to 21. Among these funds, he largest stake in Credit Acceptance Corp. (NASDAQ:CACC) was held by Abrams Bison Investments, which reported holding $210.6 million worth of stock as of the end of June. It was followed by BloombergSen with a $150.6 million position. Other investors bullish on the company included Cantillon Capital Management, Goodnow Investment Group, and Makaira Partners.

Follow Credit Acceptance Corp (NASDAQ:CACC)

Follow Credit Acceptance Corp (NASDAQ:CACC)

Receive real-time insider trading and news alerts

Goodnow inched up its stake in Aircastle Limited (NYSE:AYR) by 2% to 1.85 million shares valued at $36.72 million during the third quarter. Meanwhile, the stock appreciated by 2.7% during the same period. Heading into the third quarter of 2016, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, up by 75% from the previous quarter. Ric Dillon’s Diamond Hill Capital has the number one position in Aircastle Limited (NYSE:AYR), worth close to $54.7 million at the end of June. Other funds bullish on the company included John Overdeck and David Siegel’s Two Sigma Advisors, Israel Englander’s Millennium Management and Neil Chriss’s Hutchin Hill Capital.

Follow Aircastle Ltd (NYSE:AYR)

Follow Aircastle Ltd (NYSE:AYR)

Receive real-time insider trading and news alerts

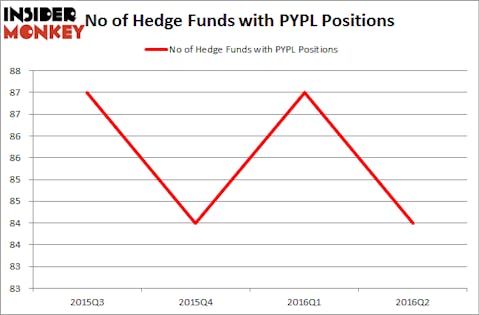

On the other hand, in Paypal Holdings Inc (NASDAQ:PYPL), Goodnow trimmed its stake by 5% during the third quarter to 914,426 shares worth $37.46 million. However, as the stock gained 12.2% between July and September, the position jumped to the second spot in the fund’s equity portfolio. Overall, the number of funds followed by us long Paypal Holdings Inc (NASDAQ:PYPL) declined to 84 from 87 during the second quarter. More specifically, Icahn Capital LP reported the largest holding, which was worth $1.24 billion at the end of June. It was followed by Orbis Investment Management with a $490 million position. Other investors bullish on the company included Lone Pine Capital, D E Shaw, and Coatue Management.

Follow Paypal Holdings Inc. (NASDAQ:PYPL)

Follow Paypal Holdings Inc. (NASDAQ:PYPL)

Receive real-time insider trading and news alerts

Commscope Holding Company Inc (NASDAQ:COMM) saw Goodnow cut its position by 18% during the third quarter, after having increased it by 55% in the previous three months. In this way, as the stock declined by 3% during the third quarter, Goodnow held 763,112 shares worth $22.97 million at the end of September. There were 47 funds from our database holding shares of Commscope Holding Company at the end of June, up by 31% over the quarter. Among these funds, Chieftain Capital was the largest shareholder of Commscope Holding Company Inc (NASDAQ:COMM), with a stake worth $476.5 million reported as of the end of June. Trailing Chieftain Capital was Maverick Capital, which amassed a stake valued at $473 million. FPR Partners, Route One Investment Company, and Corvex Capital also held valuable positions in the company.

Disclosure: none