Hedge funds may not always be right, even collectively, but data shows that their consensus long positions have historically outperformed broader market benchmarks. For example, the Goldman Sachs’ VIP list, which includes the 50 stocks that appear the most often among hedge funds’ top-10 largest holdings, has beaten the S&P 500 gauge on a quarterly basis 64% of the time since 2001, including last year, when it delivered impressive 23% returns in a flat market. Meanwhile, Goldman Sachs’ list of the 20 ‘Most Concentrated’ stocks, which hedge funds own the highest percentage of in terms of the stock’s float, has gained 18% this year to the S&P 500’s 8% gains. Clearly, it’s worthwhile to pay attention to what hedge funds are buying, so let’s check out the latest 13F filing data to see what they think about W W Grainger Inc (NYSE:GWW).

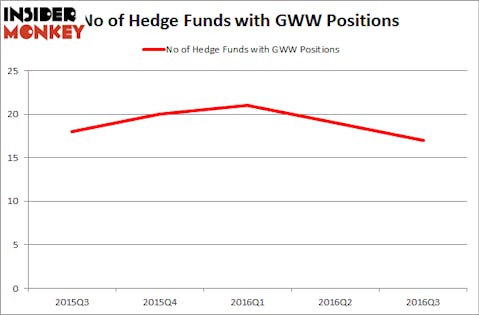

W W Grainger Inc (NYSE:GWW) shareholders have witnessed a decrease in hedge fund sentiment last quarter, as the number of funds tracked by us betting on the stock declined to 17 from 19. At the end of this article we will also compare GWW to other stocks including Loews Corporation (NYSE:L), Magna International Inc. (USA) (NYSE:MGA), and United Continental Holdings Inc (NYSE:UAL) to get a better sense of its popularity.

Follow W.w. Grainger Inc. (NYSE:GWW)

Follow W.w. Grainger Inc. (NYSE:GWW)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Photology1971/Shutterstock.com

Keeping this in mind, we’re going to check out the recent action encompassing W W Grainger Inc (NYSE:GWW).

Hedge fund activity in W W Grainger Inc (NYSE:GWW)

At the end of September, 17 of the hedge funds tracked by Insider Monkey held long positions in W W Grainger Inc (NYSE:GWW), which represents a decline 11% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GWW over the last five quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Citadel Investment Group, led by Ken Griffin, holds the number one position in W W Grainger Inc (NYSE:GWW). Citadel Investment Group has a $44.4 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second most bullish fund manager is Pittencrieff Partners – Gabalex Capital, led by Nigel Greig and Kenneth Cowin, holding a $27 million position; the fund has 9.4% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that are bullish consist of Dmitry Balyasny’s Balyasny Asset Management, Cliff Asness’ AQR Capital Management and Joel Greenblatt’s Gotham Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.