We recently published a list of 15 AI Stocks Surging on News and Analyst Ratings. In this article, we are going to take a look at where Vertiv Holdings Co (NYSE:VRT) stands against other AI stocks that are surging on news and analyst ratings.

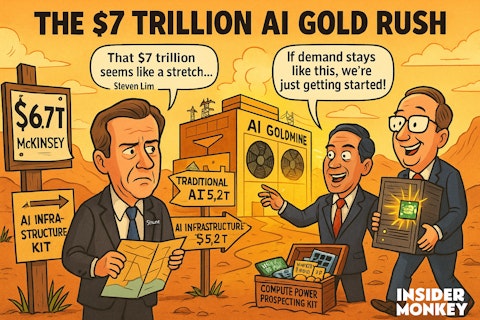

According to an analysis by global management consulting firm McKinsey & Company, data centers are projected to require $6.7 trillion in capital expenditures worldwide by 2030 to keep up with the demand for compute power.

Those data centers that are equipped to handle AI processing loads are projected to require $5.2 trillion in capital expenditures. Meanwhile, those powering traditional IT applications are projected to require $1.5 trillion, totaling up to a staggering figure close to $7 trillion.

READ NEXT: 11 AI Stocks On Wall Street’s Radar and 10 Trending AI Stocks on Wall Street Right Now

The report further claims that the companies that anticipate compute power demand and invest accordingly will win the AI-driven computing era. By proactively securing critical resources such as land, materials, energy capacity, and computing power, they would have the potential to gain a significant competitive edge.

Different analysts seem to have differing perspectives on this $7 trillion figure. Wes Cummins, CEO of Applied Digital, believes that the $7 trillion estimate appears to be “on the high end.”

“If we’re talking just the next five years, I think that’s a hard number to hit, just from the practicality of building and finding enough power.”

On the other hand, Steven Lim from NTT Global Data Centers asserted that the large figure is not that far-fetched.

“If we have an idealized situation and a consistent demand curve that we see today, then $7 trillion is not out of bounds.”

While the opinions on the feasibility of this estimate may vary, one thing that is clear is that the race to build AI-ready infrastructure is accelerating. As the demand for compute power surges to new heights, the ability to scale efficiently will determine which companies will lead the AI era and which ones will fall behind.

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds. The hedge fund data is as of Q4 2024.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

Vertiv Holdings Co (NYSE:VRT)

Number of Hedge Fund Holders: 91

Vertiv Holdings Co (NYSE:VRT) offers digital infrastructure technology and services for data centers, communication networks, and commercial and industrial facilities. On May 19, the critical digital infrastructure provider confirmed its strategic alignment with NVIDIA’s announcement of 800 VDC power architectures for future AI-centric data centers. The 800 VDC power portfolio by Vertiv is planned for release in the second half of 2026, ahead of NVIDIA Kyber and NVIDIA Rubin Ultra platform rollouts.

The goal of this strategic alignment is to enable customers to deploy their power and cooling infrastructure in alignment with NVIDIA’s next-generation compute platforms. A major advantage of the 800 VDC is that it enables more efficient and centralized power delivery through reducing copper usage, current, and thermal losses. This is particularly useful now that rack power requirements in AI environments are scaling beyond 300 kilowatts.

“As GPUs evolve to support increasingly complex AI applications at giga-watt scale, power and cooling providers need to be equally innovative to provide energy-efficient and high-density solutions for the AI factories. While the 800 VDC portfolio is new, DC power isn’t a new direction for us, it’s a continuation of what we’ve already done at scale. We’ve spent decades deploying higher-voltage DC architectures across global telecom, industrial, and data center applications. We’re entering this transition from a position of strength and bringing real-world experience to meet the demands of the AI factory.”

-Scott Armul, executive vice president of global portfolio and business units at Vertiv.

Overall, VRT ranks 7th on our list of AI stocks that are surging on news and analyst ratings. While we acknowledge the potential of VRT as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than VRT and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires.

Disclosure: None. This article is originally published at Insider Monkey.