World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

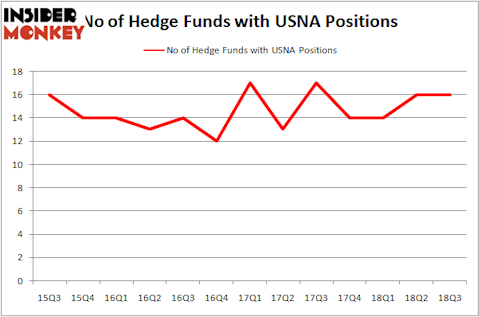

USANA Health Sciences, Inc. (NYSE:USNA) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 16 hedge funds’ portfolios at the end of the third quarter of 2018. At the end of this article we will also compare USNA to other stocks including CVR Refining LP (NYSE:CVRR), First Financial Bancorp (NASDAQ:FFBC), and Genesis Energy, L.P. (NYSE:GEL) to get a better sense of its popularity.

In the eyes of most traders, hedge funds are perceived as underperforming, old financial tools of years past. While there are greater than 8,000 funds with their doors open today, We look at the upper echelon of this group, approximately 700 funds. These hedge fund managers watch over bulk of the hedge fund industry’s total asset base, and by shadowing their matchless picks, Insider Monkey has discovered numerous investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a look at the fresh hedge fund action regarding USANA Health Sciences, Inc. (NYSE:USNA).

How are hedge funds trading USANA Health Sciences, Inc. (NYSE:USNA)?

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, no change from the second quarter of 2018. By comparison, 14 hedge funds held shares or bullish call options in USNA heading into this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons’s Renaissance Technologies has the number one position in USANA Health Sciences, Inc. (NYSE:USNA), worth close to $253.1 million, corresponding to 0.3% of its total 13F portfolio. Coming in second is Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holding a $39.7 million position; 0.1% of its 13F portfolio is allocated to the company. Some other peers that are bullish encompass Noam Gottesman’s GLG Partners, Israel Englander’s Millennium Management and Cliff Asness’s AQR Capital Management.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s now review hedge fund activity in other stocks similar to USANA Health Sciences, Inc. (NYSE:USNA). These stocks are CVR Refining LP (NYSE:CVRR), First Financial Bancorp (NASDAQ:FFBC), Genesis Energy, L.P. (NYSE:GEL), and Rexford Industrial Realty Inc (NYSE:REXR). All of these stocks’ market caps match USNA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CVRR | 2 | 113511 | -4 |

| FFBC | 7 | 20139 | -2 |

| GEL | 2 | 2431 | -2 |

| REXR | 13 | 318479 | -4 |

| Average | 6 | 113640 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $114 million. That figure was $414 million in USNA’s case. Rexford Industrial Realty Inc (NYSE:REXR) is the most popular stock in this table. On the other hand CVR Refining LP (NYSE:CVRR) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks USANA Health Sciences, Inc. (NYSE:USNA) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.