Why am I doing this?

Recently, Nobel Prize winner Daniel Kahneman visited Fool headquarters in Virginia. While visiting, he talked about how a number of different biases can lead us to believe we can predict the future with relative certainty. In reality, he argued, we’re just deluding ourselves.

It got me to thinking about how I don’t write enough about the risks of owning the stocks I own. So although I don’t plan on selling my IPG stock anytime soon, I think it’s healthy for me to practice and model this behavior.

Let’s go over the three points.

Disrupting the disruptor

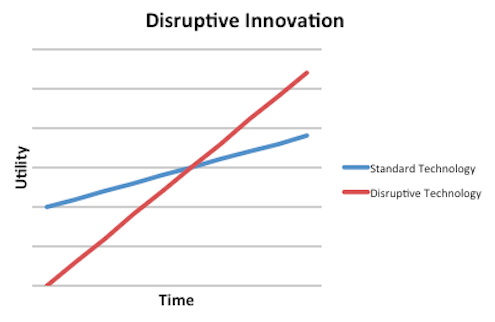

When I purchased shares of IPG Photonics Corporation (NASDAQ:IPGP) last April, I used this chart as the basis for my investing thesis.

Source: Author, based on The Innovator’s Dilemma by Clayton Christensen

This is my own representation of an idea gleaned from Clayton Christensen’s The Innovator’s Dilemma. The book demonstrates how new technologies eventually usurp standard technologies. Just as important, while standard technologies usually maintain the same price point, newer technologies become cheaper with time.

For decades, the standard technology in the laser industry has been the carbon-based laser. In reality, these lasers are still commonly used, and sold in bulk by the likes of Rofin-Sinar Technologies (NASDAQ:RSTI) and Coherent, Inc. (NASDAQ:COHR). They are used largely for precision cutting of large pieces of metal.

But starting in the 1990s, when IPG Photonics Corporation (NASDAQ:IPGP) was founded, a new type of laser began developing. Though IPG’s fiber optic lasers were at first far too expensive, and not powerful enough, to gain wide acceptance, that has changed with time. Now, IPG’s lasers are more efficient, and powerful, than their carbon-based partners, and can compete on price to boot!

The problem, however, is that there could be further disruption right around the corner. I am far from being an expert in lasers — and I’m guessing the same is true of many Fools. Because of that, it’s going to be very difficult for me to see a newer laser — one that’s even cheaper and more powerful than fiber optics — coming to the market. If that does happen, IPG Photonics Corporation (NASDAQ:IPGP) could quickly lose market share.

The downside of vertical integration

While IPG Photonics Corporation (NASDAQ:IPGP) was the first on the scene with fiber optic lasers, it’s no longer the only company with skin in the game. Rofin-Sinar Technologies (NASDAQ:RSTI) and Coherent, Inc. (NASDAQ:COHR) now offer fiber optic lasers along side their carbon lasers. Furthermore, JDS Uniphase Corp (NASDAQ:JDSU), which focuses much more on the communications industry, has entered the fray by offering clients fiber optic lasers.