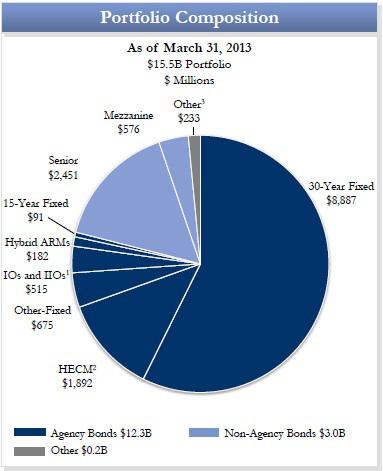

Two Harbors Investment Corp (NYSE:TWO) is one of the hybrid REITs in the US, and has large investments in both Agency and non-Agency residential mortgage backed securities. Other financial assets form about 5% – 10% of its entire portfolio. The following chart display the current proportion of each security within its portfolio at the end of the first quarter.

The company recently announced it is further diversifying its business and entering new areas which will increase profits for the company as the US housing markets continue to recover. The company is considering including the following in its portfolio:

Mortgage Servicing Rights (MSR): MSRs are natural interest rate hedges and also act to leverage Two Harbors Investment Corp (NYSE:TWO)’ strength in prepayment analysis. To purse it further, Two Harbors purchased Matrix Financial Services Corp at the beginning of May 2013. With this acquisition, Two Harbors Investment Corp (NYSE:TWO) now has the seller-servicer approvals from all the three Agencies.

Securitization: The company indulged in a prime jumbo securitization during the first quarter of the current year and intends to continue to do so in the coming quarters.

Credit Sensitive Loans (CSLs): These are similar to performing residential mortgage loans in sub-prime deals. The company intends to hold servicing on these loans in the future. Most recently, the company purchased CSLs worth $450 million in market value for approximately $600 million. The addition of CSLs will create attractive credit investment opportunities for Two Harbors Investment Corp (NYSE:TWO).

I believe Two Harbors Investment Corp (NYSE:TWO)’ expansion plans provide the company with tremendous growth potential, particularly when the US housing is showing little signs of improvement even after Fed’s stimulus.

Two Harbors’ diversification is in contrast to the concentration of fixed rate Agency residential mortgage backed securities held by Annaly Capital Management, Inc. (NYSE:NLY) and American Capital Agency Corp. (NASDAQ:AGNC). These are two of the largest and the most followed pure-play mREITs. While they are both exclusively invested in Agency RMBS, the nature of their portfolios differ.

American Capital Agency Corp. (NASDAQ:AGNC) holds low coupon, low loan balance and low maturity MBS. These characteristics are considered to enhance prepayment protection, which is why American Capital reported one of the lowest CPRs.

On the other hand, Annaly is invested in long maturity, high loan balance and high coupon MBS, which are considered to have high prepayments during times when the yield curve is flattening. These accelerated prepayments have hurt the company’s profitability and its dividend distributions over the past few quarters.

Dividends

The Fed’s stimulus efforts have caused many mREITs to slash their dividend distributions. However, over the past few quarters Two Harbors has been able to maintain its dividend rate. In fact, a closer look reveals that Two Harbors has actually increased its annual dividend. During the full-year 2011, it paid $1.6 in dividends per share, while it increased to $1.71 during 2012. This was due to the special dividend attributed to the Sliver Bay Realty Trust distributions. The annual dividend for the full-year 2013 is anticipated to be over $2 per share, as the quarterly dividend rate is restored to $0.4 per share.

In comparison, American Capital Agency has been able to maintain its quarterly dividend rate of $1.25 per share since December 2011. However, on an annual basis, the company paid $5.60 per share during 2011, while the distribution decreased to $5 per share during 2012. I anticipate that the company will be able to maintain its annual dividend rate during 2013.