In this article, we will take a look at the top 10 losers on Tuesday. If you want to check out some other stocks losing value today, go directly to Top 5 Losers on Tuesday.

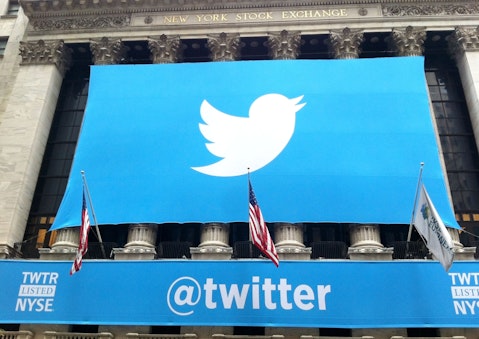

Microblogging platform Twitter, Inc. (NYSE:TWTR), pharmaceutical giant Pfizer Inc. (NYSE:PFE) and communications technology company Zoom Video Communications, Inc. (NASDAQ:ZM) were among the top losers of this morning.

Shares of Zoom Video Communications, Inc. (NASDAQ:ZM) fell after issuing a weak financial outlook for its fiscal third quarter, while Twitter, Inc. (NYSE:TWTR) shares dropped after its ex-security head made serious allegations against the company. On the other hand, shares of Pfizer Inc. (NYSE:PFE) slipped apparently after disclosing a lower efficacy of its Covid-19 vaccine for young children.

Many other stocks, including Medtronic plc (NYSE:MDT) and XPeng Inc. (NYSE:XPEV), were also losing value this morning. Check out the complete article to see why these stocks are trading lower today.

Anthony Correia / Shutterstock.com

10. Flexsteel Industries, Inc. (NASDAQ:FLXS)

Number of Hedge Fund Holders: 7

Shares of Flexsteel Industries, Inc. (NASDAQ:FLXS) fell over 8 percent after the opening bell today after the wooden furniture products maker missed profit expectations for its fiscal fourth quarter.

Flexsteel Industries, Inc. (NASDAQ:FLXS) reported adjusted earnings of 41 cents per share, down from 61 cents per share in the year-ago period. Analysts were looking for earnings of 43 cents per share.

In addition, Flexsteel Industries, Inc. (NASDAQ:FLXS) posted revenue of $124.5 million, representing a drop of 8.6 percent over the corresponding period of 2021. However, revenue numbers surpassed the consensus of $119.42 million.

Gross margin dropped to 14.2 percent in Q4, from 19.4 percent in the same period last year. Among other developments, Flexsteel Industries, Inc. (NASDAQ:FLXS) reported that it repurchased $7.1 million worth of its common stock during the quarter.

9. Baozun Inc. (NASDAQ:BZUN)

Number of Hedge Fund Holders: 11

Shares of Baozun Inc. (NASDAQ:BZUN) fell to a nearly three-month low this morning following its mixed financial performance for the second quarter. The e-commerce solutions provider reported adjusted earnings of $0 per ADS, missing the estimates of $0.09 per ADS.

Revenue for the quarter slipped 7.9 percent versus last year to $316.8 million but came in above expectations of $310 million. Baozun Inc. (NASDAQ:BZUN) also released its segment-wise sales results. Its product revenue fell 28.6 percent to $103.6 million, while services revenue increased 7.2 percent to $213.2 million in the quarter.

Like Baozun Inc. (NASDAQ:BZUN), shares of Zoom Video Communications, Inc. (NASDAQ:ZM), Pfizer Inc. (NYSE:PFE) and Twitter, Inc. (NYSE:TWTR) also moved down this morning.

8. DLocal Limited (NASDAQ:DLO)

Number of Hedge Fund Holders: 17

Shares of DLocal Limited (NASDAQ:DLO) fell to a nearly one-month low before the opening bell on Tuesday. The drop came after the Uruguayan fintech company released its second-quarter results.

DLocal Limited (NASDAQ:DLO) reported earnings of 10 cents per share, up from 6 cents per share in the second quarter of 2021. Revenue came in at $101.2 million, representing a jump of 71.6 percent on a year-over-year basis. Analysts were looking for earnings of 10 cents per share on revenue of $98.53 million.

Among other updates, DLocal Limited (NASDAQ:DLO) reported that total payment volume (TPV) jumped 67 percent to $1.5 billion in the quarter.

7. XPeng Inc. (NYSE:XPEV)

Number of Hedge Fund Holders: 24

XPeng Inc. (NYSE:XPEV) posted a wider-than-expected loss for the second quarter along with a weak outlook. As a result, its shares fell nearly five percent in the pre-market trading session on Tuesday.

The Chinese electric vehicle (EV) maker reported an adjusted loss of about $368 million on revenue of $1.1 billion. On the other hand, analysts expected XPeng Inc. (NYSE:XPEV) to report a loss of $288 million on revenue of $1.1 billion.

Total vehicle deliveries for the quarter stood at 34,422 versus 17,398 in the comparable period of 2021. Looking forward, XPeng Inc. (NYSE:XPEV) projected vehicle deliveries of about 30,000 for the current quarter, well below the consensus of 45,000.

XPeng Inc. (NYSE:XPEV) also issued its sales guidance for the third quarter. It expects to produce revenue of around $1 billion in the current quarter, lower than analysts’ average estimate of approx. $1.5 billion.

6. DocuSign, Inc. (NASDAQ:DOCU)

Number of Hedge Fund Holders: 37

Shares of DocuSign, Inc. (NASDAQ:DOCU) extended their downward movement today, slipping over two percent after the opening bell. The drop follows a downgrade from RBC Capital analyst Rishi Jaluria, who lowered his ratings for the electronic signature solutions provider from “Outperform” to “Sector Perform.”

Jaluria thinks DocuSign, Inc. (NASDAQ:DOCU) would likely face challenges in the near term as it looks for a new CEO. In addition, he referred to a series of weak financial performances of the company. Jaluria trimmed his price target for DocuSign, Inc. (NASDAQ:DOCU) from $80 per share to $65 per share.

Separately, investment management firm Rowan Street Capital also talked about DocuSign, Inc. (NASDAQ:DOCU) in its first-quarter 2022 investor letter, stating:

“We have been following Docusign (NASDAQ:DOCU) since its IPO in 2018. It’s stratospheric valuations over the past few years have kept us admiring this company from the sidelines. We took advantage of the recent drastic drop in stock price to build a core position for the fund.”

Click to continue reading and see Top 5 Losers on Tuesday.

Suggested articles:

- 6 Favorite Stock Picks of Munir Javeri’s 3G Sahana Capital Management

- 9 Tech Stocks that Cathie Wood is Giving Up On

- The 10 Best Value ETFs to Invest In

Disclosure: None. Top 10 Losers on Tuesday is originally published on Insider Monkey.