TimesSquare Capital Management, an equity investment management company, released its “U.S. Mid Cap Growth Strategy” first quarter 2025 investor letter. A copy of the letter can be downloaded here. At the beginning of 2025, a general sense of optimism prevailed among businesses and markets. The expectations for a pro-business atmosphere with reduced regulatory burdens boosted global markets in January. However, in February, delays and uncertainties surrounding U.S. policies led to a more cautious market response, culminating in a significant decline in March. In this environment, the strategy returned -3.29% (gross) and -3.48% (net) while the Russell Midcap Growth Index returned -7.12%. In addition, please check the fund’s top five holdings to know its best picks in 2025.

In its first-quarter 2025 investor letter, TimesSquare Capital U.S. Mid Cap Growth Strategy highlighted stocks such as Teradyne, Inc. (NASDAQ:TER). Teradyne, Inc. (NASDAQ:TER) is a technology company that offers automated test systems and robotics products. The one-month return of Teradyne, Inc. (NASDAQ:TER) was 9.22%, and its shares lost 43.16% of their value over the last 52 weeks. On June 18, 2025, Teradyne, Inc. (NASDAQ:TER) stock closed at $86.26 per share, with a market capitalization of $13.838 billion.

TimesSquare Capital U.S. Mid Cap Growth Strategy stated the following regarding Teradyne, Inc. (NASDAQ:TER) in its Q1 2025 investor letter:

“We had a different view on Teradyne, Inc. (NASDAQ:TER), a leading producer of testing and measurement equipment for semiconductors and other complex electronic systems. Although its revenues and earnings were higher than forecasted, Teradyne’s management lowered its guidance for the full year. The company had presented an optimistic picture of the broad industry outlook, but was unable to translate that to its own sales expectations. On a later analyst day, Teradyne again tempered its outlook, and we exited the position as it declined by -29% for the partial quarter.”

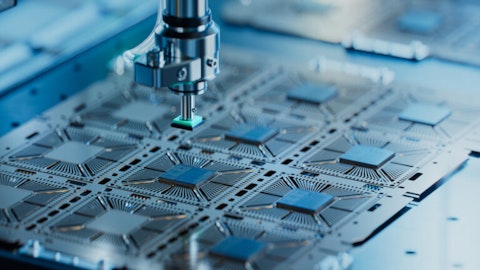

Close-up of Silicon Die are being Extracted from Semiconductor Wafer and Attached to Substrate by Pick and Place Machine. Computer Chip Manufacturing at Fab. Semiconductor Packaging Process.

Teradyne, Inc. (NASDAQ:TER) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 49 hedge fund portfolios held Teradyne, Inc. (NASDAQ:TER) at the end of the first quarter, which was 61 in the previous quarter. While we acknowledge the potential of Teradyne, Inc. (NASDAQ:TER) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the undervalued AI stock set for massive gains.

In another article, we covered Teradyne, Inc. (NASDAQ:TER) and shared the list of latest analyst views on Coatue’s favorite AI stocks. In addition, please check out our hedge fund investor letters Q1 2025 page for more investor letters from hedge funds and other leading investors. While we acknowledge the potential of TER as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.