Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track more than 700 prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile gigantic failures like hedge funds’ recent losses in Valeant. Let’s take a closer look at what the funds we track think about Thor Industries, Inc. (NYSE:THO) in this article.

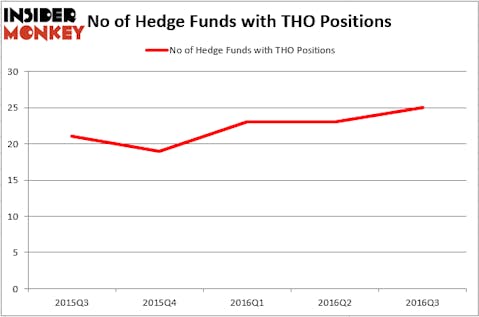

Thor Industries, Inc. (NYSE:THO) has experienced an increase in hedge fund interest recently. THO was in 25 hedge funds’ portfolios at the end of September. There were 23 hedge funds in our database with THO positions at the end of the previous quarter. At the end of this article we will also compare THO to other stocks including Ionis Pharmaceuticals Inc (NASDAQ:IONS), LATAM Airlines Group SA (ADR) (NYSE:LFL), and Endurance Specialty Holdings Ltd. (NYSE:ENH) to get a better sense of its popularity.

Follow Thor Industries Inc (NYSE:THO)

Follow Thor Industries Inc (NYSE:THO)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

lassedesignen/Shutterstock.com

How have hedgies been trading Thor Industries, Inc. (NYSE:THO)?

Heading into the fourth quarter of 2016, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, an increase of 9% from the second quarter of 2016. On the other hand, there were a total of 19 hedge funds with a bullish position in THO at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Royce & Associates, led by Chuck Royce, holds the largest position in Thor Industries, Inc. (NYSE:THO). Royce & Associates has a $124.2 million position in the stock. Coming in second is AQR Capital Management, led by Cliff Asness, which holds a $46.3 million position. Some other professional money managers that are bullish include Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital, and Michael O’Keefe’s 12th Street Asset Management. We should note that 12th Street Asset Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, specific money managers have jumped into Thor Industries, Inc. (NYSE:THO) headfirst. Jim Simons’ Renaissance Technologies created the most outsized position in Thor Industries, Inc. (NYSE:THO). Renaissance Technologies had $31 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also initiated a $10.7 million position during the quarter. The following funds were also among the new THO investors: Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Paul Marshall and Ian Wace’s Marshall Wace LLP, and D. E. Shaw’s D E Shaw.

Let’s check out hedge fund activity in other stocks similar to Thor Industries, Inc. (NYSE:THO). These stocks are Ionis Pharmaceuticals Inc (NASDAQ:IONS), LATAM Airlines Group SA (ADR) (NYSE:LFL), Endurance Specialty Holdings Ltd. (NYSE:ENH), and Eaton Vance Corp (NYSE:EV). All of these stocks’ market caps are closest to THO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IONS | 23 | 202101 | 7 |

| LFL | 8 | 40575 | 3 |

| ENH | 18 | 306751 | 0 |

| EV | 9 | 15421 | -1 |

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $141 million. That figure was $318 million in THO’s case. Ionis Pharmaceuticals Inc (NASDAQ:IONS) is the most popular stock in this table. On the other hand LATAM Airlines Group SA (ADR) (NYSE:LFL) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Thor Industries, Inc. (NYSE:THO) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None