Look at these three companies’ margin histories and current price-to-earnings ratios, and tell me which is the best deal:

You probably picked McDonald’s Corporation (NYSE:MCD), or maybe Chipotle Mexican Grill, Inc. (NYSE:CMG), but definitely not CEC Entertainment, Inc. (NYSE:CEC). You would probably be wrong, though. CEC Entertainment, Inc. (NYSE:CEC)’s operations may not be in the best shape, but its capital allocation makes it a hidden bargain.

You could be forgiven for picking McDonald’s Corporation (NYSE:MCD). It is the world’s leading fast food company and still has opportunities to expand abroad. The company generates gobs of free cash flow from lucrative franchise arrangements around the world and has increased earnings per share at a whopping 18% per year over the last decade.

The restaurant business is tough, even for a wide-moat company like McDonald’s Corporation (NYSE:MCD). The company’s same-store sales have been getting hammered over the last two years and earnings growth is hard to come by all of a sudden. In fact, the company has been struggling recently, but new product roll outs like the popular McCafe products that were introduced in 2009 provided new growth amid declining core sales.

Lousy operations, but great stock

Things are not any easier for CEC Entertainment, Inc. (NYSE:CEC). The owner of Chuck E. Cheese restaurants has been in decline for more than a decade; its margins have decreased nearly every year since the turn of the millennium, and the trend is unlikely to change direction any time soon.

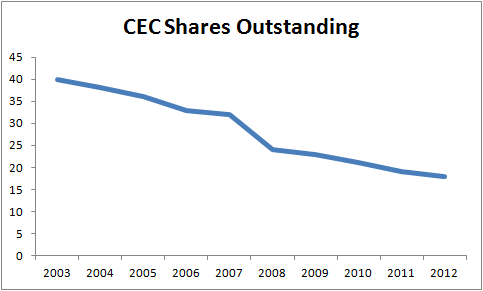

Remarkably, the stock has returned 8.3% per year since 2000 vs the S&P 500’s 3.4% (both figures include dividends). It achieved this outperformance through regular share repurchases. Investors who bought CEC in 2003 and held through today now own twice as much of the company as they had originally purchased.

It is this incredible effect — that of increasing value per share even as the value of the entire company declines — that makes CEC a special investment. It continues to increase earnings per share even as its absolute earnings decline.

There may be more upside hidden in the stock. With nationwide scale, CEC has a tremendous advantage over its competitors, typically local putt putt operators, ice skating rinks, and community pools. The company is working to improve profitability by reworking its cost structure; CEO Mike Magusiak noted on the second-quarter conference call that the company improved its margin after reducing food prices (to draw in customers) and increasing token prices.