The market has been volatile in the last 6 months as the Federal Reserve continued its rate hikes and then abruptly reversed its stance and uncertainty looms over trade negotiations with China. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 9 percentage points. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, though some funds increased their exposure dramatically at the end of Q4 and the beginning of Q1. In this article, we analyze what the smart money thinks of Bottomline Technologies (de), Inc. (NASDAQ:EPAY) and find out how it is affected by hedge funds’ moves.

Bottomline Technologies (de), Inc. (NASDAQ:EPAY) has seen a decrease in hedge fund interest in recent months. Our calculations also showed that EPAY isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are a lot of formulas shareholders put to use to evaluate their stock investments. A duo of the most innovative formulas are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the best hedge fund managers can outclass the broader indices by a healthy amount (see the details here).

Cliff Asness of AQR Capital Management

We’re going to take a gander at the fresh hedge fund action regarding Bottomline Technologies (de), Inc. (NASDAQ:EPAY).

What have hedge funds been doing with Bottomline Technologies (de), Inc. (NASDAQ:EPAY)?

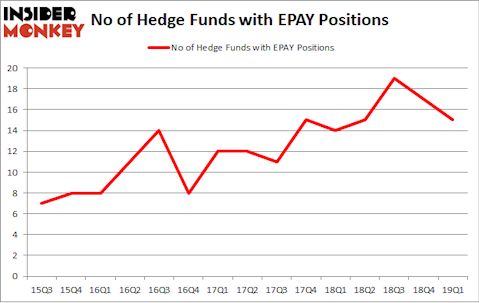

At the end of the first quarter, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -12% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in EPAY over the last 15 quarters. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Ken Fisher’s Fisher Asset Management has the biggest position in Bottomline Technologies (de), Inc. (NASDAQ:EPAY), worth close to $19.7 million, comprising less than 0.1%% of its total 13F portfolio. Coming in second is Daruma Asset Management, led by Mariko Gordon, holding a $18.8 million position; 2.1% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that hold long positions encompass Israel Englander’s Millennium Management, Jim Simons’s Renaissance Technologies and Cliff Asness’s AQR Capital Management.

Because Bottomline Technologies (de), Inc. (NASDAQ:EPAY) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there exists a select few hedgies that slashed their positions entirely last quarter. Intriguingly, Dmitry Balyasny’s Balyasny Asset Management sold off the largest stake of the “upper crust” of funds monitored by Insider Monkey, totaling an estimated $3 million in stock. Ravee Mehta’s fund, Nishkama Capital, also dropped its stock, about $1.8 million worth. These transactions are intriguing to say the least, as total hedge fund interest dropped by 2 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to Bottomline Technologies (de), Inc. (NASDAQ:EPAY). These stocks are Pattern Energy Group Inc (NASDAQ:PEGI), Intelsat S.A. (NYSE:I), InterDigital, Inc. (NASDAQ:IDCC), and Mantech International Corp (NASDAQ:MANT). This group of stocks’ market valuations are closest to EPAY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PEGI | 10 | 24823 | -1 |

| I | 54 | 733520 | 12 |

| IDCC | 16 | 172766 | -5 |

| MANT | 12 | 16915 | 2 |

| Average | 23 | 237006 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $237 million. That figure was $100 million in EPAY’s case. Intelsat S.A. (NYSE:I) is the most popular stock in this table. On the other hand Pattern Energy Group Inc (NASDAQ:PEGI) is the least popular one with only 10 bullish hedge fund positions. Bottomline Technologies (de), Inc. (NASDAQ:EPAY) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately EPAY wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); EPAY investors were disappointed as the stock returned -8.1% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.