At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

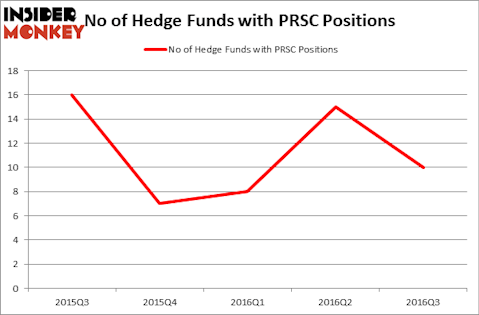

Is The Providence Service Corporation (NASDAQ:PRSC) a marvelous investment at the moment? Investors who are in the know are unambiguously of the opinion that this is not really the case at this exact moment of time. The number of bullish hedge fund investments shrank by 5 recently. PRSC was in 10 hedge funds’ portfolios at the end of the third quarter of 2016. There were 15 hedge funds in our database with PRSC holdings at the end of the second quarter. At the end of this article we will also compare PRSC to other stocks including A10 Networks Inc (NYSE:ATEN), Ehi Car Services Ltd (ADR) (NYSE:EHIC), and Photronics, Inc. (NASDAQ:PLAB) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Iakov Filimonov/Shutterstock.com

Hedge fund activity in The Providence Service Corporation (NASDAQ:PRSC)

At the end of the third quarter, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 33% dip from one quarter earlier. By comparison, 7 hedge funds held shares or bullish call options in PRSC heading into this year, so hedge fund ownership of the stock is still up in 2016. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Christopher Shackelton and Adam Gray’s Coliseum Capital has the most valuable position in The Providence Service Corporation (NASDAQ:PRSC), worth close to $95.7 million, amounting to 33.6% of its total 13F portfolio. Coming in second is Renaissance Technologies, one of the largest hedge funds in the world, holding a $45.5 million position. Other hedge funds and institutional investors that hold long positions include Paul Reeder and Edward Shapiro’s PAR Capital Management, Ken Griffin’s Citadel Investment Group, and Israel Englander’s Millennium Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

Due to the fact that The Providence Service Corporation (NASDAQ:PRSC) has weathered falling interest from the smart money, it’s easy to see that there was a specific group of hedgies who sold off their full holdings last quarter. At the top of the heap, Amy Minella’s Cardinal Capital dumped the biggest position of all the investors monitored by Insider Monkey, worth about $20.2 million in stock. Glenn Russell Dubin’s fund, Highbridge Capital Management, also said goodbye to its stock, about $0.5 million worth.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as The Providence Service Corporation (NASDAQ:PRSC) but similarly valued. We will take a look at A10 Networks Inc (NYSE:ATEN), Ehi Car Services Ltd (ADR) (NYSE:EHIC), Photronics, Inc. (NASDAQ:PLAB), and US Concrete Inc (NASDAQ:USCR). This group of stocks’ market caps match PRSC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATEN | 16 | 61946 | 3 |

| EHIC | 5 | 128708 | 1 |

| PLAB | 15 | 70519 | -3 |

| USCR | 23 | 133637 | 0 |

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $99 million. That figure was $159 million in PRSC’s case. US Concrete Inc (NASDAQ:USCR) is the most popular stock in this table. On the other hand Ehi Car Services Ltd (ADR) (NYSE:EHIC) is the least popular one with only 5 bullish hedge fund positions. The Providence Service Corporation (NASDAQ:PRSC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard USCR might be a better candidate to consider taking a long position in.

Disclosure: None