It might be about time to gear up for a short — or at least time to take some profits off the table. The Procter & Gamble Company (NYSE:PG) made the decision to rehire its old CEO, A.J. Lafley, to replace his handpicked successor Robert McDonald. I see this as a call for concern, given Lafley’s track record as CEO.

P&G is a great company that likely will be around forever, but it’s about to go through a rocky transition period. Here are three reasons why I am bearish on The Procter & Gamble Company (NYSE:PG).

1. Low ROE and ROIC compared to industry

The personal products industry is ultra–competitive, and companies like The Clorox Company (NYSE:CLX), Colgate-Palmolive Company (NYSE:CL), and Kimberly Clark Corp (NYSE:KMB) dominate the space.

It’s difficult for any of these firms to get a firm “leg-up” on the other. As a result, share prices of the industry leaders have moved almost in lockstep.

You will not make a killing on any of these companies because competition keeps margins and prices fairly equal. Investors look to these companies as income plays because of strong dividend yields. The question to investigate is whether these companies can maintain their performance.

When we look at each company’s return on equity and return on invested capital, we see The Procter & Gamble Company (NYSE:PG) lacks in comparison:

Return on Equity

PG Return on Equity data by YCharts.

Return on Invested Capital

PG Return on Invested Capital data by YCharts.

ROIC also measures managerial effectiveness. Companies with high ROIC are able to give back to their shareholders through dividend payouts, repurchasing stock (which increases earnings per share), and reinvesting in operations or businesses, which increases the firm’s return. Scary is the fact that P&G lags its peers in all four of the above time frames.

P&G’s competition

Kimberly Clark Corp (NYSE:KMB) is the closest of the mentioned companies to P&G’s managerial effectiveness. For a number of reasons, I see now as a time to include Kimberly-Clark in your portfolio. Its revenue growth is at 1.5% and its price is up 18% this year. In terms of retained earnings, net income and earnings per share are both increasing.

Kimberly-Clark does hold a great deal of debt that could halt dividend growth, but I believe the pros outweigh the cons with this one. Kimberly-Clark has increased its dividend by 6% per year for the past 5 years. It currently stands 3.20%, paying $3.24 per share.

As for Clorox and Colgate-Palmolive, both are booming companies.

The Clorox Company (NYSE:CLX) sells its products in more than 100 countries, and many of its brands hold the No. 1 or No. 2 market-share positions in their categories. Clorox recently bumped up its dividend by 11%, marking the 37th consecutive year for dividend increases.

And if 100 countries weren’t high enough, Colgate-Palmolive Company (NYSE:CL) sells its products in 200. A manufacturer of many well-known brands, Colgate-Palmolive has paid dividends for more than 100 years, and increased them for the last 51 years.

In the areas where these companies are succeeding, so has The Procter & Gamble Company (NYSE:PG). But, I see P&G as the least likely to maintain its efficiency, at least for now. At least it’s comforting that P&G isn’t investing in new projects with borrowed money.

Oh, wait. It is.

2. Lafley is back

Lafley initially stepped down from the CEO position in 2009 after handpicking McDonald as his successor. Unfortunately for McDonald, he came in as the recession hit, leaving him with a mess to clean up. In fact, McDonald dealt with the major spending contracts Lafley left behind, namely $54 billion for Gillette. And now the “big spender” is back.

Over his nine-year initial tenure as CEO, Lafley racked up $26 billion in long-term debt, to make the total $37 billion. He maintained a 13.43% ROIC during this time. Capital-intensive industries often finance growth through debt — but that isn’t necessary for The Procter & Gamble Company (NYSE:PG). McDonald actually paid down P&G’s debt by $4 billion in his four years at the helm, while also maintaining an average of 13% ROIC.

The two CEOs commanded very different strategies while maintaining similar managerial effectiveness. But in terms of revenue growth, there is large discrepancy:

Lafley’s first term as CEO

PG Revenue Quarterly YoY Growth data by YCharts

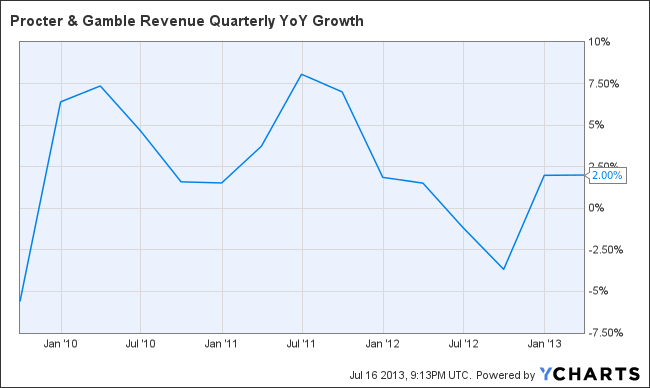

McDonald as CEO

PG Revenue Quarterly YoY Growth data by YCharts

So, why should we expect Lafley’s performance as CEO to be any different this time around?

3. Expansion into Africa with high long-term debt

Expansion into Africa might seem like a good idea for any company . Many other companieshave found success in this emerging market. According to McKinsey, emerging markets hold the key to long-term growth for consumer products companies. P&G looks to expand operationsby investing $170 million in a new plant.

But expanding requires investment, and capital. With $32.22 billion (and increasing) in long-term debt, and Lafley’s past spending habits, P&G might be getting into more debt trouble. Expansion in Africa is a great idea, but maybe not right now.

A good company, rocky times

P&G has been around for 100-plus years, and it will probably survive another 100. With a 2.9% dividend, the stock is an appealing income play. But I think headwinds are in sight.

The Procter & Gamble Company (NYSE:PG) will go through a difficult transition period. Now, near its 52-week high, I recommend shorting, taking profits, or waiting for a pullback before going long. I see this stock bottoming out near support around $70 before it climbs back up. Long-term, P&G has a strong outlook and can be trusted moving forward. But first, it needs to clean up its balance sheet and ante up returns on its capital. And until it does, I’ll stay bearish.

This article was written by Andrew Deckert and edited by Chris Marasco. Chris Marasco is Head Editor of ADifferentAngle. Neither has a position in any stocks mentioned. The Motley Fool recommends Kimberly-Clark and Procter & Gamble. Marie is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

The article 3 Reasons I’m Bearish on This Household-Name Stock originally appeared on Fool.com and is written by Marie Palumbo.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.