There are three topics that you can write or talk about that are almost guaranteed to draw a audience, stocks (because greed drives us all), sex (no reason needed) and salvation. I am not an expert on the latter two, and I am not sure that I have that much that is original to say about the first. That said, in my niche, which is valuation, many start with the presumption that almost every topic you pick is boring. Obviously, I do not believe that, but there are some topics in valuation that are tough to care about, unless they are connected to real events or current news.

One issue that I have always wanted to write about is the potential for a feedback loop between price and value (I can see you already rolling your eyes, and getting ready to move on..), but with the frenzy around

GameStop Corp. (NYSE: GME) and AMC Entertainment Holdings Inc (NYSE: AMC), you may find it interesting. Specifically, a key question that many investors, traders and interested observers have been asking is whether a company, whose stock price and business is beleaguered, can take advantage of a soaring stock price to not just pull itself out of trouble, but make itself a more valuable firm. In other words, can there be a feedback loop, where increasing stock prices can pull value up, and conversely, could decreasing prices push value down?

Copyright: vadymvdrobot / 123RF Stock Photo

Price, Value and the Gap

For the third time in three posts, I am going to fall back on my divide between value and price. Value, as I have argued is a function of cash flows, growth and risk, reflecting the quality of a company’s business model. Price is determined by demand and supply, where, in addition to, or perhaps even overwhelming, fundamentals, you have mood, momentum and revenge (at least in the case of GameStop) thrown into the mix. Since the two processes are driven by different forces, there is no guarantee that the two will yield the same number for an investment or a company at a point in time:

Put simply, you can have the price be greater than value (over valued), less than value (under valued) or roughly the same (fairly valued). The last scenario is the one where markets are reasonably efficient, and in that scenario, the two processes do not leak into each other. In terms of specifics, when a stock’s value is roughly equal to its price:

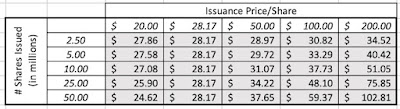

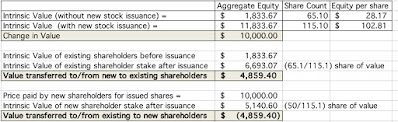

– Issuing new shares at the market price will have no effect on the value per share or the price per share, dilution bogeyman notwithstanding.

– Buying back shares at the market price will have no effect on the value per share or price per share of the remaining shares, even though the earnings per share may increase as a result of decreased share count.

Follow Gamestop Corp. (NYSE:GME)

Follow Gamestop Corp. (NYSE:GME)

Receive real-time insider trading and news alerts

– Perception: While nothing fundamentally has changed in the company, a rise (fall) in its stock price, makes bondholders/lenders more willing to slacken (tighten) constraints on the firm and increase (decrease) the chances of debt being renegotiated. It also affects the company’s capacity to attract or repel new employees, with higher stock prices making a company a more attractive destination (especially with stock-based compensation thrown into the mix) and lower stock prices having the opposite effect.

– Implicit effects: When a company’s stock price goes up or down, there can be tangible changes to the company’s fundamentals. If a company has a significant amount of debt that is weighing it down, creating distress risk, and some of it is convertible, a surge in the stock price can result in debt being converted to equity on favorable terms (fewer shares being issued in return) and reduce default risk. Conversely, if the stock price drops, the conversion option in convertible debt will melt away, making it almost all debt, and pushing up debt as a percent of value. A surge or drop in stock prices can also affect a company’s capacity to retain existing employees, especially when those employees have received large portions of their compensation in equity (options or restricted stock) in prior years. If stock prices rise (fall), both options and restricted stock will gain (lose) in value, and these employees are more (less) likely to stay on to collect on the proceeds.

– Explicit effects: If a company’s stock price rises well above value, companies will be drawn to issue new shares at that price. While I will point out some of the limits of this strategy below, the logic is simple. Issuing shares at the higher price will bring in cash into the company and it will augment overall value per share, even though that augmentation is coming purely from the increase in cash. Companies can use the cash proceeds to pay down debt (reducing the distress likelihood) or even to change their business models, investing in new models or acquiring them. If a company’s stock price falls below value, a different set of incentives kick in. If that company buys back shares at that stock price, the value per share of the remaining shares will increase. To do this, though, the company will need cash, which may require divestitures and shrinking the business model, not a bad outcome if the business has become a bad one.

1. Regulations and legal restrictions: A share issuance by a company that is already public is a secondary offering, and while it is less involved than a primary offering (IPO), there are still regulatory requirements that take time and require SEC approval. Specifically, a company planning a secondary offering has to file a prospectus (S-3), listing out risks that the company faces, how many shares it plans to issue and what it plans to use the proceeds for. That process is not as time consuming or as arduous as it used to be, but it is not instantaneous; put simply, a company that sees its stock price go up 10-fold in a day won’t be able to issue shares the next day.

2. Demand, supply and momentum: If the price is set by demand and supply, increasing the supply of shares will cause price to drop, but the effect is much more insidious. To the extent that the demand for an over valued stock is driven by mood and momentum, the very act of issuing shares can alter momentum, magnifying the downward pressure on stock prices. Put simply, a company that sees it stock price quadruple that then rushes a stock issuance to the market may find that the act of issuing the shares, unless pre-planned, May itself cause the price rise to unravel.

3. Value transfer, not value creation: Even if you get past the regulatory and demand/supply obstacles, and are able to issue the shares at the high price, it is important that you not operate under the delusion that you have created value in that stock issuance. The increase in value per share that you get comes from a value transfer, from the shareholders who buy the newly issued shares at too high a price to the existing shareholders in the company.

4. Cash and trust: If you can live with the value transfer, there is one final hurdle. The new stock issuance will leave the company with a substantial cash balance, and if the company’s business model is broken, there is a very real danger that managers, rather than follow finding productive ways to fix the model, will waste the cash trying to reinvent themselves.

Follow Amc Entertainment Holdings Inc. (NYSE:AMC)

Follow Amc Entertainment Holdings Inc. (NYSE:AMC)

Receive real-time insider trading and news alerts

– Perception: For the moment, the rise in the stock price has bought breathing room in both companies, as lenders back off, but that effect is likely to be transient. Perception alone cannot drive up value.

– Implicit effects: On this dimension, AMC has already derived tangible benefits, as $600 million in convertible debt will become equity, making the company far less distressed. For those Redditors primed for revenge against Wall Street, it is worth noting that the biggest beneficiary in this conversion is Silver Lake, a hedge fund that invested in these bonds in the dark days for the company. GameStop’s debt is more conventional borrowing, and while bond prices have gone up, the benefits don’t accrue as directly to the company.

– Explicit effects: On this dimension again, AMC is better positioned, having already filed a prospectus for a secondary offering on December 11, well ahead of the stock run-up. In that offering, AMC filed for approval for issuance of up to 178 million additional shares, from time to time, primarily to pay down debt. If the stock price stays elevated, and that is a big if, AMC will be able to issue shares at a price > value and increase its value per share. It is unclear whether GameStop has the time to even try to do this, especially if the stock price rise dissipates in days or weeks, rather than months.

Disclosure: None

Follow Insider Monkey on Twitter