Therefore, conservative long-term investors should consider a unique approach to investing in the processed food stocks, by way of the two largest peanut butter producers in America – The J.M. Smucker Company (NYSE:SJM) and Hormel Foods Corporation (NYSE:HRL).

The J.M. Smucker Company (NYSE:SJM) is usually known for its fruit spreads, but it also owns Jif, which has been the best-selling peanut butter in the United States for the past three decades. Hormel owns Skippy, which trails Jif domestically but is more popular internationally.

J.M. Smucker promises cheaper PB&J sandwiches (and coffee) for all

J.M. Smucker’s main business is generated from three product categories – The J.M. Smucker Company (NYSE:SJM)’s fruit jam, Jif peanut butter and packaged coffee. That trio of popular brands helped boost its bottom line 25% to $1.22 per share, or $130.3 million, during the fourth quarter. The company’s sales volume rose 2%, fueled by 6% growth in domestic retail coffee and a 4% gain in domestic retail consumer foods. However, Smucker’s total revenue declined 1.2% year-on-year to $1.34 billion.

That drop was attributed to a 6% price reduction in its packaged retail coffee brands, which include Folgers and Dunkin’ Donuts. It was an intentional effort to sacrifice some top line growth to generate more lower-priced sales volume. During the quarter, Dunkin’ Donuts coffee was its best-selling packaged coffee brand, posting 29% year-on-year sales growth. The J.M. Smucker Company (NYSE:SJM) also sells K-Cups of its popular coffee brands, which are used with Green Mountain Coffee Roasters Inc. (NASDAQ:GMCR)’ popular Keurig single-serve brewers.

Smucker also lowered the price of its peanut butter and fruit preserves by 10% and 11%, respectively, due to lower commodity costs. The company expects prices for coffee, peanuts and sweeteners to trend lower for the rest of the year, but prices for milk and flour to rise. Lower commodity costs contributed to a 4.7% decline in The J.M. Smucker Company (NYSE:SJM)’s input costs, which boosted gross margin from 33.2% to 35.8%.

Smucker is spending heavily on its new marketing initiatives, which include new television commercials, digital marketing initiatives and other promotions. I believe that these promotions will lead nicely into the back-to-school season, which should generate higher sales as parents pack their kids’ lunchboxes with peanut butter and jelly sandwiches.

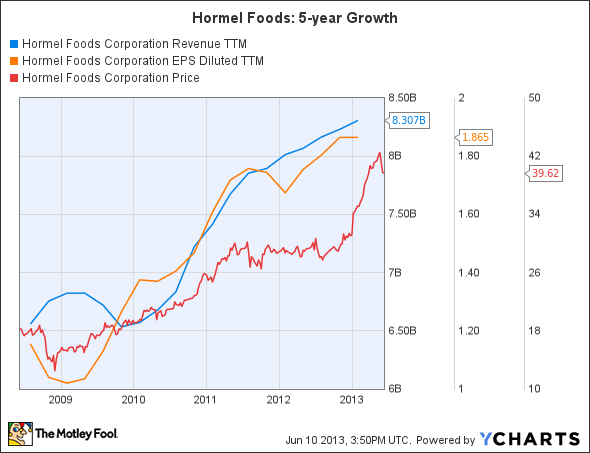

Hormel realizes that meat sandwiches aren’t as profitable as PB&J

Hormel Foods Corporation (NYSE:HRL), on the other hand, is exposed to a different market. Although the company produces Skippy peanut butter, it is usually associated with pork products and its Spam luncheon meat. Hormel Foods Corporation (NYSE:HRL)’s most recent quarterly earnings were the opposite of The J.M. Smucker Company (NYSE:SJM)’s, reporting a bottom line decline on top line growth. The company’s earnings slid 2% to $0.46 per share, or $125.5 million, but revenue rose 6.9% to $2.15 billion.

Hormel Foods Corporation (NYSE:HRL)’s sore spot was its Jennie-O Turkey Store business, which accounts for 18% of its top line. The segment reported a 2% sales decline and a 25.9% plunge in operating profit, which it attributed to waning demand for turkey and higher grain costs. Hormel’s refrigerated products segment, which accounts for nearly half of the company’s top line, also posted a 2% revenue decline and a 3.2% drop in operating profit, which it also attributed to higher grain costs.

However, its grocery products segment, which includes Skippy peanut butter, Spam, Dinty Moore stew and Mary Kitchen hash, helped offset some of those losses. The segment, which accounts for 18% of Hormel Foods Corporation (NYSE:HRL)’s top line, reported 49% sales growth and 10.4% bottom line growth, fueled by strong demand for peanut butter.

Compared to Smucker, Hormel Foods Corporation (NYSE:HRL)’s businesses are less aligned with each other. A notable problem is that the cost of grain is outpacing the cost of turkeys and hogs.

However, the recent takeover of Smithfield Foods, Inc. (NYSE:SFD), the world’s largest pork producer, by Chinese pork producer Shuanghui International Holdings, indicates that global demand for pork products will continue to rise. In addition, North American turkey sales should accelerate into the Thanksgiving and Christmas holiday season. Therefore, the back-to-school and holiday seasons could help steer Hormel’s sales in the right direction again later this year.

ConAgra’s forgotten peanut butter brand

Although Jif and Skippy are the largest peanut butter brands in the world, a smaller brand, ConAgra Foods, Inc. (NYSE:CAG)’ Peter Pan, is also notable. ConAgra Foods, Inc. (NYSE:CAG) is the largest processed foods manufacturer in America, and is best known for Chef Boyardee pasta, Hunt’s Ketchup, Orville Redenbacher’s popcorn, and Swiss Miss hot chocolate.

ConAgra recently acquired private-brand foods and foodservice giant Ralcorp Holdings for $5 billion, which is expected to add $0.05 per share to its adjusted fiscal 2013 profit. ConAgra recently reported a 57% decline in profit to $0.29 per share, or $280.1 million, primarily due to this acquisition, but sales rose 13% to $3.85 billion. Ralcorp contributed $292 million and $5 million to ConAgra’s top and bottom lines, respectively.

Although Peter Pan peanut butter comprises a tiny part of ConAgra Foods, Inc. (NYSE:CAG)’s revenue, in comparison to Smucker and Hormel Foods Corporation (NYSE:HRL), the lower commodity costs that The J.M. Smucker Company (NYSE:SJM) had forecast last quarter should also be a boon to ConAgra this year.

The Foolish Bottom Line

Warren Buffett once famously stated, “A ham sandwich could run The Coca-Cola Company (NYSE:KO).” I’d like to modify that quote slightly to say, “A peanut butter and jelly sandwich could power up your portfolio.”

For me, a peanut butter and jelly sandwich represents a beautiful simplicity that investors should appreciate. It is made from three simple ingredients, which have been in high demand for the past century. It shows a timeless resilience in times of economic prosperity and despair. Therefore, the companies that produce products related to peanut butter and jelly sandwiches (packaged food products) will remain in constant demand despite economic turbulence and can be robust investments when things get tough.

The article Investing in the Perfect Peanut Butter & Jelly Sandwich originally appeared on Fool.com and is written by Leo Sun.

Leo Sun has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Leo is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.