Eyeing the real estate recovery, Home Depot had already prepared a plan to target professional customers, which included increasing inventory of pro-focused products such as plywood and fast-drying paints, setting up of separate checkout counters and increasing sales efforts towards contractors. The result was that Home Depot ended up increasing its sales to professionals by 35% while Lowe’s could only manage 25%.

The higher professional sales also gave a boost to comparable-store sales and average ticket, two of the leading indicators in this industry’s earnings, which then drives the stock price. I believe that Home Depot’s strong pro-sales performance was one of the reasons behind its delivery of significantly better comparable-store sales than Lowe’s.

Conclusion

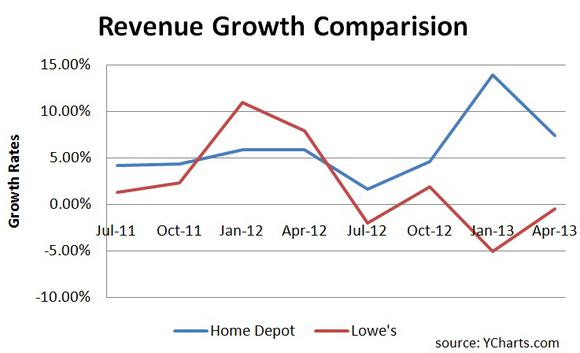

In short, effective marketing efforts and better merchandising have given Home Depot a significant lead over Lowe’s Companies, Inc. (NYSE:LOW). Home Depot’s investors should be pleased with the company’s proactive approach and I believe that this will give them more confidence in the top management. In the previous four quarters, Home Depot’s average growth was 6.91%, while Lowe’s, which has reported three year-over-year revenue drops in four previous quarters, has fallen by an average of 1.4%. This is shown in the picture below.

For the current quarter, investors should expect better performance from outdoor merchandise units of both Home Depot and Lowe’s Companies, Inc. (NYSE:LOW) due to the late start of the spring-garden season. Home Depot could post a significant increase in comparable-store sales, which could be even greater than its overall sales growth due to the seasonal shift.

Strong comparable-store sales numbers could drive the stock higher after the next earnings release. Investors should note that for the month of April, the comparable-store sales at Home Depot increased by as much as 10%.

For Lowe’s Companies, Inc. (NYSE:LOW), although the results were far from satisfactory, the company has reiterated its full-year guidance. Improvements are expected in the current quarter, particularly in May, as indicated by the chief executive Robert Niblock in the earnings call. However, due to the broader reasons explained above, I believe Home Depot’s second-quarter earnings will be better than Lowe’s.

Sarfaraz Khan has no position in any stocks mentioned. The Motley Fool recommends Home Depot and Lowe’s.

The article Home Depot Rises As Lowe’s Struggles originally appeared on Fool.com and is written by Sarfaraz Khan.

Sarfaraz is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.