Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze The Hain Celestial Group, Inc. (NASDAQ:HAIN) from the perspective of those elite funds.

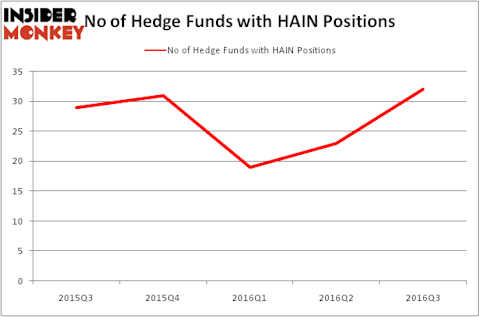

The Hain Celestial Group, Inc. (NASDAQ:HAIN) was included in the equity portfolios of 32 funds from our database at the end of the third quarter. HAIN investors should pay attention to an increase in activity from the world’s largest hedge funds in recent months. There were 23 funds in our database with HAIN holdings at the end of the previous quarter. At the end of this article we will also compare HAIN to other stocks including Highwoods Properties Inc (NYSE:HIW), Zions Bancorporation (NASDAQ:ZION), and Dicks Sporting Goods Inc (NYSE:DKS) to get a better sense of its popularity.

Follow Hain Celestial Group Inc (NASDAQ:HAIN)

Follow Hain Celestial Group Inc (NASDAQ:HAIN)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

Copyright: stocking / 123RF Stock Photo

Now, we’re going to check out the recent action encompassing The Hain Celestial Group, Inc. (NASDAQ:HAIN).

Hedge fund activity in The Hain Celestial Group, Inc. (NASDAQ:HAIN)

At the end of September, 32 funds tracked by Insider Monkey were bullish on this stock, up by 39% from the previous quarter. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Philippe Laffont’s Coatue Management has the biggest position in The Hain Celestial Group, Inc. (NASDAQ:HAIN), worth close to $76.4 million, corresponding to 0.9% of its total 13F portfolio. The second largest stake is held by Keith Meister of Corvex Capital, with a $51.4 million position; the fund has 1% of its 13F portfolio invested in the stock. Remaining professional money managers that are bullish consist of David Tepper’s Appaloosa Management LP, Christopher James’s Partner Fund Management and Jim Simons’ Renaissance Technologies.

As industrywide interest jumped, some big names have been driving this bullishness. Corvex Capital initiated the biggest position in The Hain Celestial Group, Inc. (NASDAQ:HAIN). Christopher James’s Partner Fund Management also initiated a $34.1 million position during the quarter. The other funds with new positions in the stock are Jim Simons’ Renaissance Technologies, Alec Litowitz and Ross Laser’s Magnetar Capital, and James Dondero’s Highland Capital Management.

Let’s check out hedge fund activity in other stocks similar to The Hain Celestial Group, Inc. (NASDAQ:HAIN). We will take a look at Highwoods Properties Inc (NYSE:HIW), Zions Bancorporation (NASDAQ:ZION), Dicks Sporting Goods Inc (NYSE:DKS), and Parsley Energy Inc (NYSE:PE). This group of stocks’ market valuations are similar to HAIN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HIW | 5 | 94726 | -5 |

| ZION | 39 | 471895 | -1 |

| DKS | 41 | 690241 | -3 |

| PE | 47 | 1139354 | 6 |

As you can see these stocks had an average of 33 hedge funds with bullish positions and the average amount invested in these stocks was $599 million. That figure was $388 million in HAIN’s case. Parsley Energy Inc (NYSE:PE) is the most popular stock in this table. On the other hand Highwoods Properties Inc (NYSE:HIW) is the least popular one with only 5 bullish hedge fund positions. The Hain Celestial Group, Inc. (NASDAQ:HAIN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Parsley Energy Inc (NYSE:PE) might be a better candidate to consider a long position.