Mairs & Power, an investment advisor, released the “Mairs & Power Balanced Fund” first quarter 2025 investor letter. A copy of the letter can be downloaded here. The stock market reached a record high in February. However, tariff uncertainty in March led to a fall in equities, while fixed income benefited from perceived safety. The fund ended the quarter up 0.04%. The fund outperformed the benchmark composite indexes (60% S&P 500 Total Return Index and 40% Bloomberg U.S. Government/Credit Bond Index), down 1.48%, and the Morningstar Moderate Allocation peer group, which fell 0.34%. In addition, please check the fund’s top five holdings to know its best picks in 2025.

In its first-quarter 2025 investor letter, Mairs & Power Balanced Fund highlighted stocks such as Texas Instruments Incorporated (NASDAQ:TXN). Texas Instruments Incorporated (NASDAQ:TXN) is a semiconductor manufacturer. The one-month return of Texas Instruments Incorporated (NASDAQ:TXN) was -4.96%, and its shares lost 12.43% of their value over the last 52 weeks. On May 6, 2025, Texas Instruments Incorporated (NASDAQ:TXN) stock closed at $161.09 per share with a market capitalization of $146.35 billion.

Mairs & Power Balanced Fund stated the following regarding Texas Instruments Incorporated (NASDAQ:TXN) in its Q1 2025 investor letter:

“Our preference for stable cash flow companies led to additional outperformance in the sector, with heavy overweights to Texas Instruments Incorporated (NASDAQ:TXN) and Motorola Solutions (MSI) benefiting relative returns. Texas Instruments has been on a multi-year business transition, investing heavily in semiconductor manufacturing facilities which are based in the U.S. Domestic facilities combined with general industrial end market weakness has kept the company from experiencing the same excitement as many of the other semiconductor companies.”

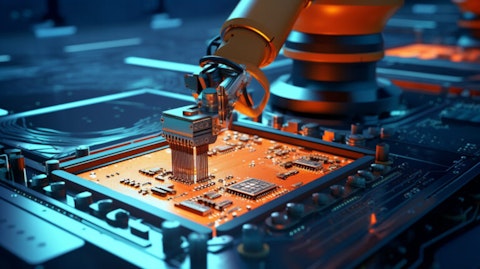

A robotic arm in the process of assembling a complex circuit board – showing the industrial scale the company operates at.

exas Instruments Incorporated (NASDAQ:TXN) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 66 hedge fund portfolios held Texas Instruments Incorporated (NASDAQ:TXN) at the end of the fourth quarter compared to 57 in the third quarter. Texas Instruments Incorporated (NASDAQ:TXN) reported revenue of $4.1 billion in Q1 2025, an increase of 2% sequentially and 11% year over year. While we acknowledge the potential of Texas Instruments Incorporated (NASDAQ:TXN) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we covered Texas Instruments Incorporated (NASDAQ:TXN) and shared the list of best dividend stocks for passive income. In addition, please check out our hedge fund investor letters Q1 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.