Baron Funds released its “Baron Durable Advantage Fund” second-quarter 2025 investor letter. A copy of the letter can be downloaded here. The fund primarily focuses on investing in securities of large-sized companies. The fund increased 15.6% (Institutional Shares) in the second quarter compared to a 10.9% return for the S&P 500 Index (the Index). The Fund is up 7.5%, year to date, compared to the 6.2% gain for the Index. After two consecutive years of strong market recovery, there was a correction at the end of the first quarter and the early part of the second quarter. But later in the second quarter, the market rebounded meaningfully. For more information on the fund’s best picks in 2025, please check its top five holdings.

In its second-quarter 2025 investor letter, the Baron Durable Advantage Fund highlighted stocks such as Texas Instruments Incorporated (NASDAQ:TXN). Texas Instruments Incorporated (NASDAQ:TXN) is a semiconductor manufacturer. The one-month return of Texas Instruments Incorporated (NASDAQ:TXN) was 8.09%, and its shares lost 1.50% of their value over the last 52 weeks. On August 7, 2025, Texas Instruments Incorporated (NASDAQ:TXN) stock closed at $200.71 per share, with a market capitalization of $182.473 billion.

Baron Durable Advantage Fund stated the following regarding Texas Instruments Incorporated (NASDAQ:TXN) in its second quarter 2025 investor letter:

“Shares of Texas Instruments Incorporated (NASDAQ:TXN), the leading global analog semiconductor company, fell 13.4% during the quarter amid investor concerns about the impact of tariffs on semiconductors and their end markets, as well as a potential delay in the industry’s cyclical recovery. The company has been investing heavily in 300 millimeter wafer capacity to support revenue growth over the next 10 to 15 years and is now nearing the end of this investment cycle. While 300 millimeter capacity offers significant cost advantages over the 200 millimeter wafers used by many competitors, Texas Instruments’ free cash flow has been meaningfully pressured in the near term. We expect free cash flow to improve as the cycle turns, revenue grows, and capital expenditures decline; however, we believe this upside is already reflected in the stock’s valuation. We sold our shares in favor of opportunities where we believe the risk/reward profiles to be more attractive.”

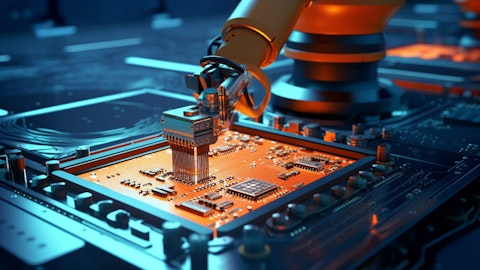

A robotic arm in the process of assembling a complex circuit board – showing the industrial scale the company operates at.

Texas Instruments Incorporated (NASDAQ:TXN) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 68 hedge fund portfolios held Texas Instruments Incorporated (NASDAQ:TXN) at the end of the second quarter, which was 69 in the previous quarter. In the second quarter of 2025, Texas Instruments Incorporated (NASDAQ:TXN) reported revenue of $4.4 billion, an increase of 9% sequentially and 16% year-over-year. While we acknowledge the risk and potential of Texas Instruments Incorporated (NASDAQ:TXN) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Texas Instruments Incorporated (NASDAQ:TXN) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Texas Instruments Incorporated (NASDAQ:TXN) and shared Diamond Hill Large Cap Fund’s views on the company. In addition, please check out our hedge fund investor letters Q2 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.