Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds and investors’ positions as of the end of the third quarter. You can find write-ups about an individual hedge fund’s trades on several financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Tesoro Corporation (NYSE:TSO) based on that data.

Tesoro Corporation (NYSE:TSO) shareholders have witnessed an increase in activity from the world’s largest hedge funds in recent months. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Expeditors International of Washington (NASDAQ:EXPD), Albemarle Corporation (NYSE:ALB), and Fortune Brands Home & Security Inc (NYSE:FBHS) to gather more data points.

Follow Andeavor (NYSE:ANDV)

Follow Andeavor (NYSE:ANDV)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

anekoho/Shutterstock.com

With all of this in mind, let’s take a look at the new action encompassing Tesoro Corporation (NYSE:TSO).

How are hedge funds trading Tesoro Corporation (NYSE:TSO)?

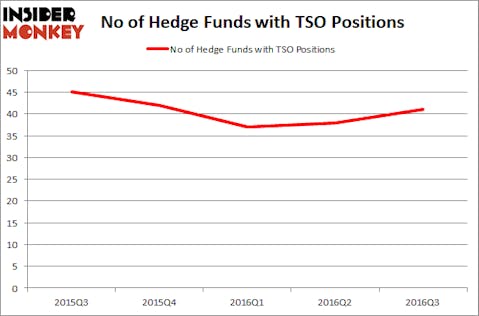

At Q3’s end, a total of 41 of the hedge funds tracked by Insider Monkey were long this stock, a change of 8% from the second quarter of 2016. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Hound Partners, managed by Jonathan Auerbach, holds the biggest position in Tesoro Corporation (NYSE:TSO). Hound Partners has a $395.5 million position in the stock, comprising 10.7% of its 13F portfolio. The second largest stake is held by AQR Capital Management, led by Cliff Asness, holding a $251 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Other peers with similar optimism comprise D. E. Shaw’s D E Shaw, and Paul Marshall And Ian Wace’s Marshall Wace LLP.

Consequently, some big names were leading the bulls’ herd. Steadfast Capital Management, managed by Robert Pitts, established the most outsized position in Tesoro Corporation (NYSE:TSO). Steadfast Capital Management had $194.3 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also initiated a $160.9 million position during the quarter. The following funds were also among the new TSO investors: Zach Schreiber’s Point State Capital, Gilchrist Berg’s Water Street Capital, and Ken Griffin’s Citadel Investment Group.

Let’s check out hedge fund activity in other stocks similar to Tesoro Corporation (NYSE:TSO). We will take a look at Expeditors International of Washington (NASDAQ:EXPD), Albemarle Corporation (NYSE:ALB), Fortune Brands Home & Security Inc (NYSE:FBHS), and CBRE Group Inc (NYSE:CBG). This group of stocks’ market valuations are closest to TSO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EXPD | 21 | 582053 | 1 |

| ALB | 38 | 882632 | -2 |

| FBHS | 25 | 332101 | 1 |

| CBG | 34 | 1890453 | 6 |

As you can see these stocks had an average of 29.5 hedge funds with bullish positions and the average amount invested in these stocks was $922 million. That figure was $1.67 billion in TSO’s case. Albemarle Corporation (NYSE:ALB) is the most popular stock in this table. On the other hand Expeditors International of Washington (NASDAQ:EXPD) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks Tesoro Corporation (NYSE:TSO) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.