Texas Instruments Incorporated (NASDAQ:TXN) is one of the Most Promising AI Stocks to Buy Now. TD Cowen upgraded the company’s stock to “Buy” from “Hold” with a price objective of $245, up from the prior target of $200, as reported by The Fly. The firm added confidence that the industrial semiconductor de-stocking has been ending. Texas Instruments Incorporated (NASDAQ:TXN) remains well-positioned to outperform in either a sharp or gradual recovery, added the firm’s analyst. The firm also added that the company’s U.S.-based manufacturing provides it with an edge as demand stabilizes.

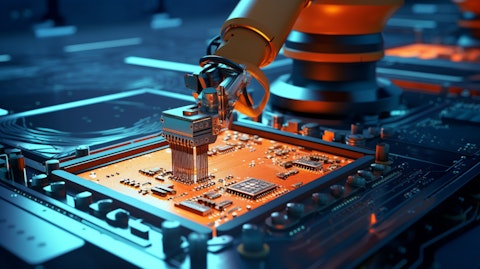

A robotic arm in the process of assembling a complex circuit board – showing the industrial scale the company operates at.

Texas Instruments Incorporated (NASDAQ:TXN) has also announced that it is working with NVIDIA to develop power management and sensing technologies for 800V high-voltage direct current (HVDC) power distribution systems for the data center servers. Notably, the new power architecture enables more scalable and reliable next-gen AI data centers. NVIDIA and Texas Instruments Incorporated (NASDAQ:TXN) have the same goal to revitalize US manufacturing through building more of the infrastructure for AI factories. NVIDIA’s CEO remains optimistic about continuing the collaboration with the company by developing products for advanced AI infrastructure.

Overall, growth in the broader AI industry is expected to continue to drive demand for Texas Instruments Incorporated (NASDAQ:TXN)’s analog and embedded chips, critical for power management, sensing, as well as connectivity in AI-driven systems such as data centers and industrial automation. Mairs & Power, an investment advisor, released its Q1 2025 investor letter. Here is what the fund said:

“Our preference for stable cash flow companies led to additional outperformance in the sector, with heavy overweights to Texas Instruments Incorporated (NASDAQ:TXN) and Motorola Solutions (MSI) benefiting relative returns. Texas Instruments has been on a multi-year business transition, investing heavily in semiconductor manufacturing facilities which are based in the U.S. Domestic facilities combined with general industrial end market weakness has kept the company from experiencing the same excitement as many of the other semiconductor companies.”

While we acknowledge the potential of TXN to grow, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than TXN and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: 13 Cheap AI Stocks to Buy According to Analysts and 11 Unstoppable Growth Stocks to Invest in Now

Disclosure: None. This article is originally published at Insider Monkey.