In China, the future for solar power looks bright. There are reports that the country may increase its upper limit for installed solar capacity to 40 GW in 2015. China’s preoccupation with political stability, and thus job creation, means that it’ll likely favor domestic producers to meet this new demand. But even with government-mandated growth, Chinese solar manufacturers do not necessarily make great investments.

Heavy debt loads and opaque markets mar many of these companies. Investors need to be cautious and realize that there are a number of negative factors impacting the Chinese solar industry. The latest news is not enough to turn everything around.

SOL Operating Income Quarterly data by YCharts

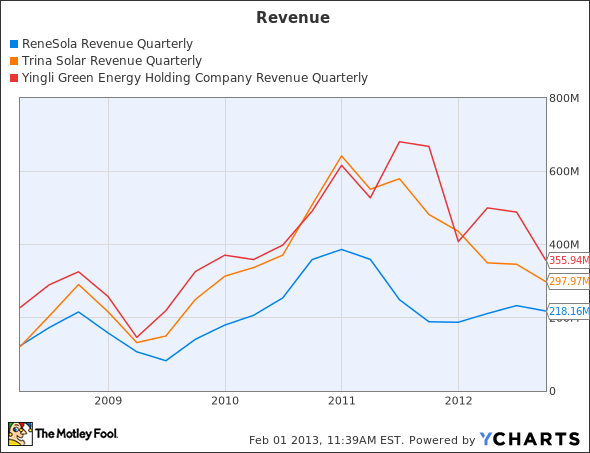

SOL Revenue Quarterly data by YCharts

The government-sponsored investment in the solar industry caused oversupply and eventual price collapse. Additionally, various feed-in tariff structures have changed, and the U.S. has slapped import tariffs on Chinese panels. Previous overinvestment may come back to haunt the Chinese manufacturers, as low capacity utilization will reduce cash flows and the ability to purchase more efficient capital goods.

ReneSola Ltd. (NYSE:SOL) is active in many parts of the solar manufacturing business. In Q3 2012, it managed to bring their wafer processing cost down to $0.15/W, and increased volume to 378.5 MW of wafers shipped. In Q3 2012, they shipped 145.3 MW of modules, which is much better than the 33.7 MW of Q3 2011. Beijing’s increasing mandates for installed solar capacity should continue to help support volumes, but its unclear if cost decreases will be strong enough to bring back the black.

The company has only $134.5 million in long term debt, but its total debt to equity ratio of 1.90 is rather high. In its latest presentation, ReneSola mentions that the “Chinese Development Bank has indicated support for further solar projects.” This perfectly demonstrates the complexity of investing in a Chinese solar manufacturer. Essentially, you have the Chinese government as an ever-present business partner. ReneSola’s high debt-to-equity ratio and gross margins of 0.5% make it a firm better left for another day.

Trina Solar Limited (NYSE:TSL) is feeling the impact of the U.S. import tariffs. From Q2 2012 to Q3 2012, the U.S. went from 26.3% to 14.5% of sales. The increase in Chinese sales from 5.0% to 13.5% helped counteract the negative pressure. Trina’s EBIT margin of -25% is alarming, though not as alarming as the $14.5 billion dollars in off-balance-sheet purchase obligations found in the firm’s 2011 20-F.