Altera Infrastructure is an international midstream service provider that owns and operates assets used in storage, production as well as transportation of products by the offshore oil and gas industry. The coronavirus outbreak has led to a sharp decrease in demand for oil, a surge in its supply and a resultant drop in oil prices to record lows. In this report, we analyze the company’s business model, exposure to near term volatility in oil, its ability to meet financial obligations, dividend prospects and finally conclude with whether the company’s preferred stock offers an attractive balance between risks and rewards.

Overview:

Incorporated as Teekay Offshore Partners L.P. with Teekay Corporation as the general partner, the company’s common stock was listed in 2006. Brookfield Business Partners (BBU), part of the Brookfield Asset Management (BAM) group has accumulated 99% of the common shares of the company since 2017 and has recently rebranded it as Altera Infrastructures L.P. The company’s common stock was de-listed this year after its acquisition by Brookfield.

Kanok Sulaiman/Shutterstock.com

Altera Infrastructure operates storage, production, and transportation assets which are mainly used by the oil and gas industry to support offshore drilling activities. Geographically, the company focuses on the offshore oil regions of the North Sea, Brazil, and the East Coast of Canada. The Company’s assets consist of floating production, storage, and offloading units, shuttle tankers, floating storage and offtake units, long-distance towing, and offshore installation vessels. The consolidated assets of Altera are valued at approximately $5.2 billion. Altera operates its business in 5 major segments:

Q1 2020 hedge fund letters, conferences and more

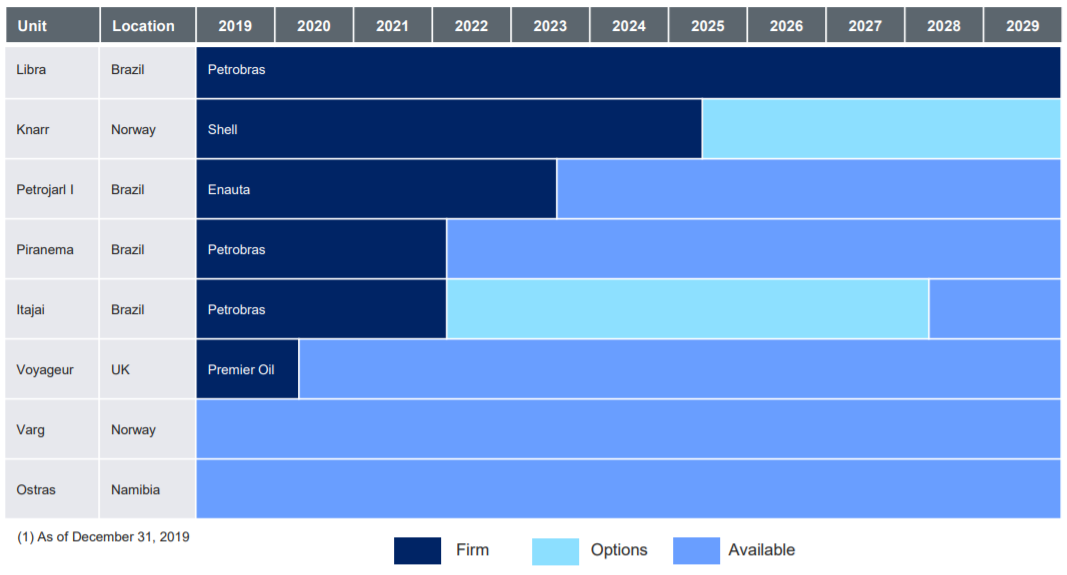

FPSO Segment: FPSO assets are floating offshore assets that provide production and storage facilities. They are mainly used to support oil fields situated in deep-water areas. An FPSO receives a mixture of crude oil, water, and impurities from risers and then separates the fluids into crude oil, natural gas, and other impurities. As of 2019, Altera had 6 FPSO assets in which it had ownership of 100%, 4 of which have been operating under contracts with major energy companies and 2 are in lay-up. It also has 50% interest in 2 FPSOs which are operating under contract in Brazil. Revenue in this segment is primarily earned through long-term, fixed-rate contracts. These contracts had an average remaining life of 3.2 years as of 2019 year-end.

Shuttle Tankers Segment: Shuttle tankers are customized ships that are used to transport oil products from offshore oil fields to onshore terminals and refineries. Altera’s shuttle tanker fleet consists of 26 vessels that are operated under fixed-term contracts of affreightment, time charters, and bareboat charters. The company also has 7 new shuttle tankers which are expected to be delivered between 2020 and 2022. The Contracts of Affreightment (COA) have an average term period of 3.4 years whereas the time charter and bareboat charter contracts have an average term period of 4.5 years. As of 2019, the total cargo capacity of 34 shuttle tankers was 4.2 million deadweight tonnes.

FSO Segment: FSO is a simplified version of FPSO. It provides on-site storage and offloading facility to oilfields but it does not possess the ability to process it. In this segment, Altera operates 5 FSO units that are under fixed-term contracts and have an average remaining contract term of 2.6 years. The total cargo capacity of these 5 assets is 0.6 million deadweight tonnes.

Towage and Offshore Installation Vessels: In this segment, the company owns and operates 10 assets which are used for towage, station-keeping, installation and decommissioning of large floating assets such as FPSOs and FSOs.

UMS Segment: In this segment, the company operates a single asset named Arendal Spirit. This asset provides offshore accommodation, storage, maintenance, and modification facility to existing offshore installations. It has 500 berths and is currently under lay-up.

As evident in the chart below, FPSO and Shuttle tankers are the largest segments of Altera. FPSO contributes 47% of the adjusted EBITDA of the company while constituting 39% of the revenue. Whereas Shuttle Tankers segment accounts for 44% of the revenue while contributing 39% of the EBITDA.

The company’s contracts with its customers are mainly long term in nature with rates fixed, therefore, its cash flows are largely immunized from the daily fluctuations in the global commodity prices, at least in the near term. Based on existing contracts as of 2019 end, Altera has $4.6 billion of forward revenue secured before including any contract options, which provide relative stability to future earnings and cash flows. The customer portfolio consists of several blue-chip companies including Shell (RDS.A) (RDS.B), Equinor (EQNR), BP (BP), and Total (TOT), to name a few. Royal Dutch Shell is the company’s largest customer accounting for 25% of revenues, followed by Equinor ASA (formerly Statoil) which contributes 13% and is majority owned by the Government of Norway.

Decline in oil prices due to COVID-19 having a severely negative impact on the broader energy industry

There has been unprecedented pressure on the global oil and gas industry because of the widespread outbreak of COVID-19. As a measure to control its spread, almost all countries have announced mild to stringent lockdowns, which has resulted in a substantial decline in global oil demand. Further, largely unchecked production levels have resulted in severe demand-supply mismatch and consequently a free fall in oil prices. Since the beginning of this year, brent oil prices have declined from the mid $60s per barrel to the low-to-mid 20s per barrel just in a span of a couple of months. The demand is forecasted to remain subdued for much of 2020 because of wide-spread reduction in business activities. As per the recent IEA report, global oil demand is expected to fall by 9.3 million barrel/day. Historic lows in oil prices are forcing oil producers to considerably reduce production levels and fixed costs. Global oil supply is set to plunge by 12 million barrel/day in May as per IEA.

Please note that, recently, all the major oil producing nations have mutually agreed to reduce oil production by 10% in the coming months in order to support prices. Although this historic deal will provide some support to prices, any major improvement is not expected in the short term unless deeper production cuts are announced, or the global economy shows some signs of turnaround despite the outbreak. As per the April IEA report:

“The measures announced by OPEC+ and the G20 countries won’t rebalance the market immediately. But by lowering the peak of the supply overhang and flattening the curve of the build-up in stocks, they help a complex system absorb the worst of this crisis.”

‘Super Contango’ in the oil market leading to boom, albeit temporary, in the tanker industry

The current highly unusual conditions in the oil market have led to windfall gains in the tanker market. The mismatched demand and supply situation has led to creation of contango which basically means there is so much excess supply at the moment that value of one barrel of oil in hand today is substantially less than value of one barrel at a later date. As a result, there has been a surge in demand for storage facilities as companies try to preserve the value of their product by holding on to it longer and investors look to profit from arbitrage opportunities. As onshore storage facilities are reaching full capacity levels, oil industry stakeholders are looking to offshore assets as storage options. This increased demand has led to a surge in spot rates or per day charges which is benefiting several tanker companies globally.

In fact, during a recent interview with CNBC, Mr. Herbjørn Hansson CEO of Nordic American tankers mentioned that they are charging $70,000 per day per ship for their Suezmax tankers which are substantially higher than average rates of approximately $30,000 in 2019. The operating costs remain at $8,000 thereby generating extraordinarily high cash flows from the assets.

“We are making a lot of money at this time, improving our balance sheet tremendously, and I have never seen such a strong market. And I’ve been around for a little while.”

Altera Infrastructure, especially its shuttle tankers segment is well placed to benefit from these contango markets. In addition to the increased pricing for vessels operating under spot contracts, the company will have an upper hand in re-negotiating its time charter contracts when they come up for renewal. Altera has 2 tankers under spot contracts which constitutes 9% of its overall fleet capacity. Also, contracts for 5 shuttle tankers which constitute 19% of its storage fleet capacity, are expiring in the next 3 months and therefore can be re-contracted at higher rates. Further, the company will receive 3 new shuttle tanker vessels in 2020 which will provide additional growth to revenue and profits assuming the demand and supply imbalance continues to exist over the next few quarters or natural demand in the industry is able to absorb additional capacity. The new fleet additions will increase total fleet capacity by 26% YoY.

Limited impact in the short term in FPSO segment, however, long-term picture murky if oil prices stay sub $25

Any large fluctuations in energy prices may not affect Altera’s FPSO and FSO business in the short run to the same extent as an oil producer, but in the medium to long term, its performance can be adversely affected. Although the majority of Altera’s revenue comes from fixed rate contracts which have over 3 years of average life, sub-$25 oil prices medium to long term will reduce the need to hire company’s assets especially since offshore drilling tends to be costlier than onshore. In the near term however limited impact from oil price dislocation is expected. The company has one FPSO which has been announced for decommissioning this year and other than that, all contracts remains active until 2022. Also, these contracts are primarily with large oil producing companies such as Petrobas (PRB) and Shell. Petrobas is majority owned by the Brazilian Government and Shell is the largest energy company in the world, therefore they are not expected to easily wither away in the ongoing storm in the oil markets due to large capital backing.

Key Contracts:

On the positive side, the decommissioned FPSO has a storage capacity of 270,000 barrels of crude oil and Altera has an excellent opportunity to source a short-term storage contract for the vessel until a suitable oil producer is found for an FPSO contract. The same opportunity lies with respect to 2 FPSOs currently in lay-up, which have a combined storage capacity of almost 700,000 barrels.

We expect that the combined effect of strong surge in storage demand and additional shuttle tankers being delivered this year will provide enough tailwind to Altera to more than offset any modest negative impact which the FPSO segment may face. Even without considering the available short-term storage opportunity in decommissioned and lay-up FPSOs, the company should be able to largely maintain its earnings power.

Preferreds are trading at a steep discount

Altera has 3 sets of preferred stock outstanding. All the preferred shares are perpetual, and the coupons are cumulative. Due to the broader market sell-off because of the coronavirus outbreak and uncertainty in the oil industry, dividend yields of all 3 preferreds reached almost 30% last month. Since then, the preferred stocks have shown significant recovery however are still trading at a dividend yield between 13 – 14%, which is still materially higher than its 12-month historical average of 9 – 10.5%. Series E is yielding the highest as of now because of its longer maturity and call period. Also, Series E has a Fixed to Floating conversion feature and after the call date, the fixed preference dividend rate will be converted to a floating rate of LIBOR + 6.4%. Series A is trading at the lowest dividend yield primarily because its call date was nearly 2 years ago, and it is expected to be the first in line to get redeemed whenever company chooses to announce a redemption plan. However, in the most recent earnings call, management suggested they have no plan to redeem any time soon.

“No, we have no plans other than to continue to have the preferred outstanding and listed and continue our reporting obligations in relation to those securities.” – Jan Rune Steinsland, CFO in Q4 2019 earnings call.

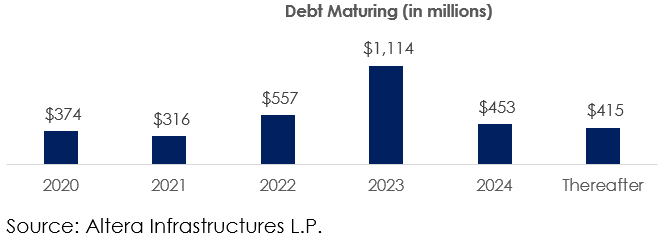

Comfortable near-term debt maturities

Altera has outstanding debt of $3.2 billion as of the end of FY 2019. The debt to EBITDA is 4.7 times and the interest coverage ratio (EBITDA to interest) is 3.4 times. Altera has $374 million of debt maturing in 2020 and already has more than $300 million of liquidity at its disposal in the form of cash and undrawn credit facility. Further, keeping in mind the free cash flow generation along with significant tailwind in the shuttle tankers segment, we do not expect the company to face any material headwinds meeting its near-term financial obligations by either paying cash or refinancing its debt.

Plenty cushion available for preferred dividend distribution

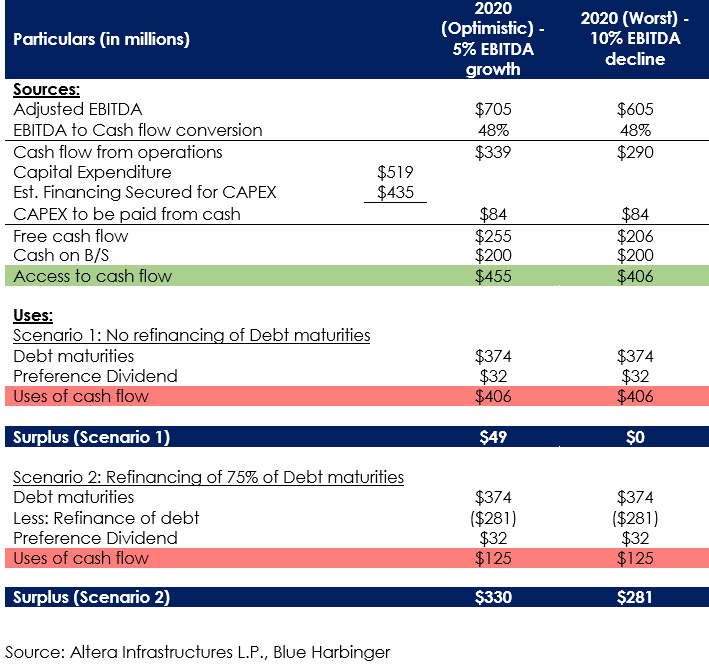

The annual preferred dividend liability amounts to just $32 million, and in the past few years, Altera has consistently maintained enough cushion for its obligations in case the business deteriorates. Please note that the company has announced dividends on preferreds just a couple of days ago on 22nd April despite the turmoil in energy markets. As indicated in the table below, we have estimated Altera’s sources and uses of cash assuming a worst-case scenario of 10% EBITDA decline as well as a slightly optimistic scenario of 5% growth in EBITDA. In both scenarios we found the preferred dividends of the company to be safe for 2020.

(1) Capital expenditure includes obligations for new shuttle tankers in 2020. These expenditures will significantly decline to $101 million and $73 million in 2021 and 2022 respectively.

(2) The financing for large part of scheduled capital expenditures related to new shuttle tankers has already been secured.

Risks:

Privatization: Brookfield Business Partners has bought all the common equity shares from the public and consequently the common stock was delisted from the exchanges. The company may not stop at common shares and also look to eliminate preferred stock from the capital structure as well, and it may take the tender offer route at a lower rate instead of calling the preferreds at par given the deep discounts preferreds trade at the moment. Additionally, it may choose to delist preferreds while not redeeming them which will significantly impact liquidity and as a result pricing of these preferreds. However, some comfort was given by management in this regard on the Q4 2019 earnings call:

“No, we have no plans other than to continue to have the preferred outstanding and listed and continue our reporting obligations in relation to those securities.” – Jan Rune Steinsland, CFO in Q4 2019 earnings call.

Further weakness in the oil market: As discussed in this report earlier, a sub-$25 oil price longer term will be detrimental to the company’s business even as the company’s business model is partially insulated in the near to medium term.

Conclusion:

The global oil industry is going through an uncertain environment because of a severe supply-demand mismatch as a result of coronavirus related global lockdowns. That said Altera’s business is largely insulated in the near term as a result of long-term contracts with blue chip customers and a temporary lift from the tanker business. At the same time, the company’s preferred shares are trading at a fairly large discount to their pre-COVID 19 yields. As such, we believe the company’s preferreds offer a strong risk reward and also provide investors an opportunity to gain low risk exposure to energy.

Looking for more attractive investment opportunities like Altera Preferreds? We offer many. Consider a membership…

Article by Blue Harbinger

Disclosure: None