We recently compiled a list of the 10 Stocks Hurting From DeepSeek AI News That Could Turn Into Multibaggers. In this article, we are going to take a look at where STMicroelectronics N.V. (NYSE:STM) stands against the other stocks.

US semiconductor stocks are getting hammered after the Chinese launched an AI model that has many questioning United States dominance in the AI space. China is currently facing restrictions on importing state-of-the-art semiconductor equipment needed for AI training. The launch of DeepSeek AI despite these restrictions is an eye-opener for Western tech companies, and the investor sentiment is reflecting it.

As market participants scamper to gather more information on China’s progress, we decided to look at stocks that are not only taking a hit from this news but also provide an attractive buy-the-dip opportunity. Against the backdrop of Project Stargate, a US government initiative to pump private sector investments into AI infrastructure, these companies also offer a potential multi-bagger opportunity.

Usually, it is the low market cap companies that become multibaggers. However, the failure rate when betting on these companies is quite high. We therefore chose companies with a market cap between $10 and $25 billion. In this way, our list contains businesses that are already established and will thrive on the boost provided by Project Stargate while successfully managing any headwinds. We believe the downside to these stocks is minimal because of the already sound fundamentals of these companies.

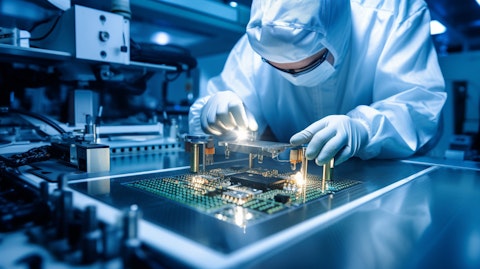

A worker assembling the inner circuitry of a semiconductor product.

STMicroelectronics N.V. (NYSE:STM)

STMicroelectronics N.V. is a semiconductor developer and supplier operating in analog, microcontrollers & digital ICs group, MEMS & sensors group, and automotive & discrete group segments. The stock was down over 2% during pre-market trading.

The cyclical nature of the industry has meant that the stock is now down 44% in one year. 2025 prospects look better though as the company focuses on increased sales and margin expansion. A re-rating resulting from this would help the company outperform the S&P 500 this year.

TD Cowen downgraded the stock to Hold recently but the stock is already trading at the $25 downgraded price target that the research firm assigned it. Any dip can therefore be considered a buying opportunity, though the semiconductor industry’s headwinds remain a concern.

Overall STM ranks 6th on our list of the stocks that are hurting from DeepSeek AI news that could turn into multibaggers. While we acknowledge the potential of STM as a leading AI investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as STM but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap

Disclosure: None. This article was originally published at Insider Monkey.