Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the 12-month period ending October 30. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 30 stock picks outperformed the S&P 500 Index by 4 percentage points through the middle of November. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

Is SPX FLOW, Inc. (NYSE:FLOW) a good stock to buy now? The smart money is getting less bullish. The number of bullish hedge fund positions decreased by 5 recently. Our calculations also showed that FLOW isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to review the fresh hedge fund action encompassing SPX FLOW, Inc. (NYSE:FLOW).

What have hedge funds been doing with SPX FLOW, Inc. (NYSE:FLOW)?

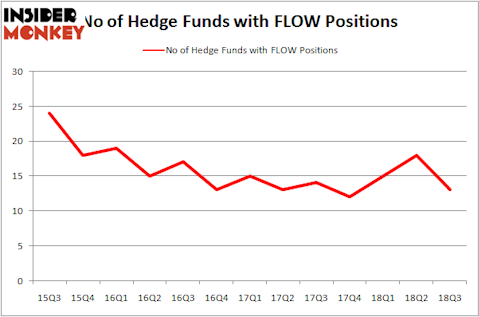

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -28% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in FLOW over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Diamond Hill Capital, managed by Ric Dillon, holds the largest position in SPX FLOW, Inc. (NYSE:FLOW). Diamond Hill Capital has a $58.2 million position in the stock, comprising 0.3% of its 13F portfolio. Sitting at the No. 2 spot is Ian Simm of Impax Asset Management, with a $53.2 million position; 0.8% of its 13F portfolio is allocated to the company. Some other peers that hold long positions contain D. E. Shaw’s D E Shaw, Peter Schliemann’s Rutabaga Capital Management and Noam Gottesman’s GLG Partners.

Since SPX FLOW, Inc. (NYSE:FLOW) has faced a decline in interest from the aggregate hedge fund industry, we can see that there is a sect of hedge funds who were dropping their positions entirely by the end of the third quarter. Intriguingly, Israel Englander’s Millennium Management sold off the biggest position of the “upper crust” of funds monitored by Insider Monkey, totaling about $3.8 million in stock, and Thomas Bailard’s Bailard Inc was right behind this move, as the fund sold off about $0.6 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest fell by 5 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to SPX FLOW, Inc. (NYSE:FLOW). These stocks are The Medicines Company (NASDAQ:MDCO), United Community Banks Inc (NASDAQ:UCBI), Nabors Industries Ltd. (NYSE:NBR), and Shutterfly, Inc. (NASDAQ:SFLY). This group of stocks’ market values match FLOW’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MDCO | 26 | 697023 | -2 |

| UCBI | 14 | 75078 | 0 |

| NBR | 39 | 440817 | 2 |

| SFLY | 23 | 550402 | -4 |

| Average | 25.5 | 440830 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $441 million. That figure was $191 million in FLOW’s case. Nabors Industries Ltd. (NYSE:NBR) is the most popular stock in this table. On the other hand United Community Banks Inc (NASDAQ:UCBI) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks SPX FLOW, Inc. (NYSE:FLOW) is even less popular than UCBI. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.