We started seeing tectonic shifts in the market during the third quarter. Small-cap stocks underperformed the large-cap stocks by more than 10 percentage points between the end of June 2015 and the end of June 2016. A mean reversion in trends bumped small-cap stocks’ return to almost 9% in Q3, outperforming their large-cap peers by 5 percentage points. The momentum in small-cap space hasn’t subsided during this quarter either. Small-cap stocks beat large-cap stocks by another 5 percentage points during the first 7 weeks of this quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were boosting their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Sony Corp (ADR) (NYSE:SNE).

Sony Corp (ADR) (NYSE:SNE) has seen a decrease in hedge fund sentiment recently. There were only 14 hedge funds in our database with SNE holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Charles Schwab Corp (NYSE:SCHW), Orange SA (ADR) (NYSE:ORAN), and Enbridge Inc (USA) (NYSE:ENB) to gather more data points.

Follow Sony Group Corp (NYSE:SONY)

Follow Sony Group Corp (NYSE:SONY)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Concept Photo/Shutterstock.com

Keeping this in mind, we’re going to take a look at the key action surrounding Sony Corp (ADR) (NYSE:SNE).

What does the smart money think about Sony Corp (ADR) (NYSE:SNE)?

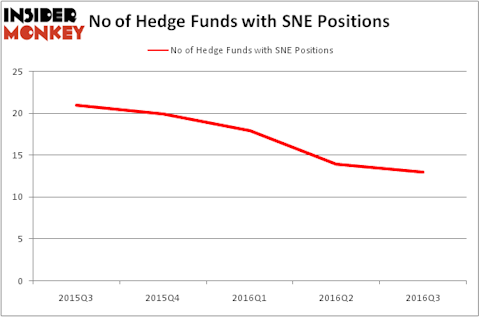

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -7% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in SNE over the last 5 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Mario Gabelli’s GAMCO Investors has the number one position in Sony Corp (ADR) (NYSE:SNE), worth close to $189.4 million, amounting to 1.2% of its total 13F portfolio. The second most bullish fund manager is Renaissance Technologies which holds a $49.9 million position; 0.1% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions comprise Spencer M. Waxman’s Shannon River Fund Management, Zweig DiMenna Partners and David Stemerman’s Conatus Capital Management. We should note that Shannon River Fund Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Due to the fact that Sony Corp (ADR) (NYSE:SNE) has witnessed declining sentiment from hedge fund managers, we can see that there exists a select few money managers that decided to sell off their full holdings last quarter. Interestingly, Ken Griffin’s Citadel Investment Group cut the largest position of the “upper crust” of funds followed by Insider Monkey, worth close to $4.8 million in call options, and Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners was right behind this move, as the fund sold off about $1.1 million worth of shares.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Sony Corp (ADR) (NYSE:SNE) but similarly valued. We will take a look at Charles Schwab Corp (NYSE:SCHW), Orange SA (ADR) (NYSE:ORAN), Enbridge Inc (USA) (NYSE:ENB), and China Telecom Corporation Limited (ADR) (NYSE:CHA). This group of stocks’ market valuations are closest to SNE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SCHW | 44 | 2680313 | 6 |

| ORAN | 1 | 59 | -3 |

| ENB | 21 | 286488 | 6 |

| CHA | 6 | 12861 | 1 |

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $745 million. That figure was $327 million in SNE’s case. Charles Schwab Corp (NYSE:SCHW) is the most popular stock in this table. On the other hand Orange SA (ADR) (NYSE:ORAN) is the least popular one with only 1 bullish hedge fund positions. Sony Corp (ADR) (NYSE:SNE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SCHW might be a better candidate to consider taking a long position in.