Shutterfly, Inc. (NASDAQ:SFLY) shares exploded to the upside. After rising over 25% on the week on strong quarterly results, investors are asking how much more upside remains. There are 4 things to look at in determining what Shutterfly shares will do next.

1) Quarterly Results

Shutterfly generated $641 million in revenue in 2012, up 35% from 2011. The acquisition of Kodak Gallery was a success, while Tiny Prints added to revenue growth. Without these two acquisitions, revenue would have increased by “only” 22%. For the quarter, earnings increased 64% to 23 million.

2) Leadership

Shutterfly is a leader in online printing. How is this retained? Shutterfly continues to innovate its product offering, improving on quality, introducing new stylish design, and keeping a focus on the customer. This innovation may be witnessed with its Cards and Stationery segment, along with the Photo Book category. Shutterfly introduced new styles and form factors, giving consumers more choice.

Consolidation within the online photo printing industry helped grow Shutterfly’s business. Customer accounts migrated from Yahoo! Inc. (NASDAQ:YHOO)! Photos, Kodak Gallery, Sony Corporation (ADR) (NYSE:SNE)’s ImageStation, and American Greetings Corporation (NYSE:AM) PhotoWorks.

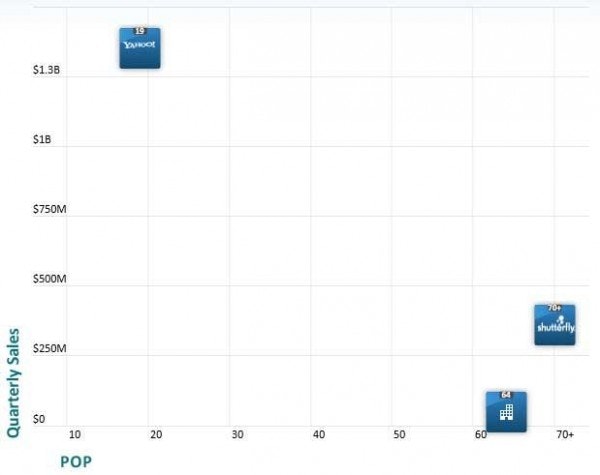

Illustrated another way, Yahoo’s Flickr was and continues to be a largely ignored asset, contributing little meaningful profits for the search giant. If investors recognize the market size for online photo sharing and printing, both Shutterfly and Shutterstock (NYSE:SSTK) could command a higher share price:

Note above, company with no label represents Shutterstock.; Source: Kapitall.com

4) Forecast, Risks, and Outlook

Fragmentation in the storage of photos is a challenge for the sector. Shutterfly recognizes that multiple devices are used by customers to capture memories. By being agnostic to device-types and systems, the company ensures that it is relevant in all segments of the market. In the last quarter, the average customer ordered $50 worth of product. This revenue, along with the margins, is hardly comparable to any other online retailer. Shutterfly reported gross margins of 60.5%.

In the next quarter, Shutterfly expects revenue to be in the range of $107.2 million and $110 million. This represents revenue growth of 20.5%. Gross margins are expected to be from 43% – 44%. EBITDA will be a loss of between $2.5 million and $3.5 million. For the year 2013, the company expects to earn $25 million to $35 million in operating income (GAAP) on revenue of between $739.7 million and $746 million.

Conclusion

Shutterfly is clearly one of the small players in the photo market, as measured by market capitalization:

| NAME | MKT CAP | AVG VOL |

| Yahoo! | $23.95B | 23,064,100 |

| Shutterfly | $1.52B | 856,956 |

| Sony | $14.97B | 3,672,680 |

| Shutterstock | $845.87M | 68,416 |

Source: Yahoo Finance

Shutterfly has a focused business, unlike broad businesses like Yahoo! Inc. (NASDAQ:YHOO) and Sony Corporation (ADR) (NYSE:SNE). This is an advantage: margins are higher when a company sticks to what it does best. The general rise in stock markets helped Yahoo and Sony trade close to their 52-week highs. Shutterstock, which is half the size of Shutterfly by market capitalization, is also up. The difference is that Shutterfly could sustain its valuation, given the strength in its business is likely to continue.

Shares are not cheap: the company expects to earn $0.38 to $0.51 in fiscal 2013, which values Shutterfly with a forward P/E of between 82 and 110. If current holders of the stock get nervous and sell shares, this could provide an opportunity for investors who missed the recent rally.

The article Shutterfly Rallies: What Happens Next originally appeared on Fool.com and is written by Chris Lau.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.