Artisan Partners, an investment management company, released its “Artisan Mid Cap Fund” second quarter 2023 investor letter. A copy of the same can be downloaded here. In the second quarter, its Investor Class fund ARTMX returned 4.44%, Advisor Class fund APDMX posted a return of 4.48%, and Institutional Class fund APHMX returned 4.49%, compared to a 6.23% return for the Russell Midcap Growth Index. Sector allocation and security selection drove the Q2 underperformance. ARTMX, APDMX, and APHMX returned 17.36%, 17.47%, and 17.48%, respectively, compared to 15.94% for the index. In addition, please check the fund’s top five holdings to know its best picks in 2023.

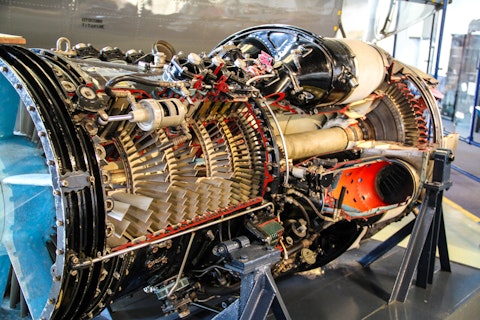

Artisan Mid Cap Fund Composite highlighted stocks like Keysight Technologies, Inc. (NYSE:KEYS) in the second quarter 2023 investor letter. Headquartered in Santa Rosa, California, Keysight Technologies, Inc. (NYSE:KEYS) is an electronic design and test solutions provider. On August 29, 2023, Keysight Technologies, Inc. (NYSE:KEYS) stock closed at $132.26 per share. One-month return of Keysight Technologies, Inc. (NYSE:KEYS) was -17.27%, and its shares lost 19.30% of their value over the last 52 weeks. Keysight Technologies, Inc. (NYSE:KEYS) has a market capitalization of $23.516 billion.

Artisan Mid Cap Fund Composite made the following comment about Keysight Technologies, Inc. (NYSE:KEYS) in its second quarter 2023 investor letter:

“We initiated new GardenSM positions in Keysight Technologies, Inc. (NYSE:KEYS), Roblox and Liberty Media Corp–Liberty Formula One during the quarter. Keysight is the leading electronic and communication test and measurement provider globally, with greater than 25% market share. Its annual R&D spending is greater than the combined total for the next three competitors, which we believe powers the innovation to maintain its leadership position and outgrow peers consistently. Over time, the company’s historical focus on telecommunication clients has diversified into multiple favorable growth markets, such as artificial intelligence, next-gen semiconductors, and electric and autonomous vehicles, which should lead to attractive organic revenue growth. Furthermore, the company is transitioning from a hardware-centric company to a software-driven solutions provider, which should drive an expansion in margins. With a valuation that we do not think reflects a high-quality franchise exposed to multiple secular growth drivers, we initiated a GardenSM position.”

Ruslans Golenkovs/Shutterstock.com

Keysight Technologies, Inc. (NYSE:KEYS) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 41 hedge fund portfolios held Keysight Technologies, Inc. (NYSE:KEYS) at the end of second quarter which was 38 in the previous quarter.

We discussed Keysight Technologies, Inc. (NYSE:KEYS) in another article and shared the list of best scientific instruments stocks to buy. In addition, please check out our hedge fund investor letters Q2 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 15 Most Profitable Cutting Edge Technologies That Will Make You Rich

- 20 Countries with Most Alcohol Deaths

- 11 Best Vegan Stocks to Buy Now

Disclosure: None. This article is originally published at Insider Monkey.