Are International Game Technology (NYSE:IGT), Express Scripts Holding Company (NASDAQ:ESRX), Aon PLC (NYSE:AON), and Colliers International Group Inc (NASDAQ:CIGI), stocks that you should be bullish on? One fund that definitely thinks so is BloombergSen. In this article, let’s take a closer look at BloombergSen’s positions in these stocks and see the general sentiment among smart money investors towards them.

Before we get to that, we should mention a couple of words about BloombergSen. The fund is managed by Jonathan Bloomberg and had an equity portfolio worth $1.02 billion at the end of September, significantly higher than $948.44 million at the end of June. The fund invests mainly in Financial stocks, which amassed 45% of its equity portfolio at the end of September, and Consumer Discretionary stocks, which represented 35%. According to our calculations, BloombergSen’s long positions in companies worth over $1.0 billion generated a positive return of 12.73%, including due to its investments in the above-mentioned stocks.

Having said that let’s proceed to the companies in question.

Zadorozhnyi Viktor/Shutterstock.com

International Game Technology (NYSE:IGT), which represented 12.9% and 15.5% of BloombergSen’s equity portfolio at the end of June and September, respectively, surged by 31.3% during the third quarter. This had a positive impact on the fund’s returns as it held 6.51 million shares at the end of June and left the stake unchanged during the third quarter. Overall, 23 funds tracked by Insider Monkey held shares of International Game Technology at the end of June, up by 5% over the quarter. Among them, BloombergSen amassed the largest stake and was followed by Polaris Capital Management with a $107.2 million position. Other investors bullish on the company included PAR Capital Management, OZ Management, and Litespeed Management.

Follow International Game Technology (NYSE:IGT)

Follow International Game Technology (NYSE:IGT)

Receive real-time insider trading and news alerts

In Express Scripts Holding Company (NASDAQ:ESRX), BloombergSen had held 1.40 million shares at the end of June and after increasing the stake by 19% during the third quarter, it reported 1.67 million shares as of the end of September. Meanwhile, during the third quarter, the stock inched down by 7%. At the end of June, there were 51 funds tracked by our team bullish on Express Scripts Holdings, down by six over the quarter. Among these funds, Bob Peck and Andy Raab’s FPR Partners had the largest position, which was worth close to $413.6 million. On FPR Partners’s heels is Cedar Rock Capital, managed by Andy Brown, with a $373.3 million stake. Remaining peers that held long positions comprise John Shapiro’s Chieftain Capital, Michael Lowenstein’s Kensico Capital and D. E. Shaw’s D E Shaw.

Follow Express Scripts Inc (NASDAQ:ESRX)

Follow Express Scripts Inc (NASDAQ:ESRX)

Receive real-time insider trading and news alerts

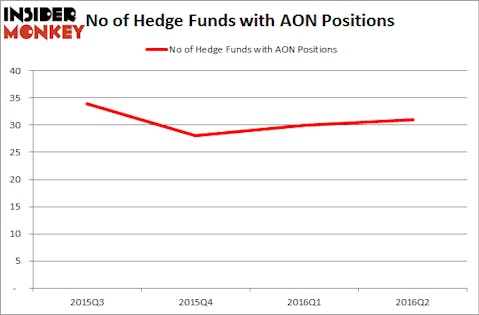

Aon PLC (NYSE:AON) posted a relatively modest gain of 3.3% during the third quarter. During the previous quarter, BloombergSen had initiated a stake in the company, having reported ownership of 535,905 shares as of the end of June and further increased it by 5% between July and September. Among the funds we track, the number of investors bullish on Aon PLC (NYSE:AON) inched up by 3% to 31 during the second quarter. Among these funds, Eagle Capital Management held the most valuable stake in , which was worth $1447.2 millions at the end of the second quarter. On the second spot was First Pacific Advisors LLC which amassed $656.1 millions worth of shares. Moreover, Abrams Bison Investments, Viking Global, and International Value Advisers were also bullish on Aon PLC (NYSE:AON).

Follow Aon Plc (NYSE:AON)

Follow Aon Plc (NYSE:AON)

Receive real-time insider trading and news alerts

Finally, Colliers International Group Inc (NASDAQ:CIGI) was represented in BloombergSen’s equity portfolio by a stake that contained 1.62 million shares at the end of June (up by 50% on the quarter) and which was further increased by 6% to 1.73 million shares during the third quarter. The fund’s conviction in the stock paid off well, as shares of Colliers advanced by 23.2% between July and September. Overall, there were 12 funds from our database bullish on Colliers International at the end of June, up by two over the quarter. BloombergSen was also the largest shareholders of Colliers and was followed by Renaissance Technologies, which amassed a stake valued at $24.6 millions. Arrowstreet Capital, Two Sigma Advisors, and AQR Capital Management also held valuable positions in the company.

Follow Colliers International Group Inc. (NASDAQ:CIGI)

Follow Colliers International Group Inc. (NASDAQ:CIGI)

Receive real-time insider trading and news alerts

Disclosure: none