Aristotle Capital Management, LLC, an investment advisor, released its “International Equity Strategy” second quarter 2023 investor letter. A copy of the same can be downloaded here. In the second quarter, Aristotle Capital’s International Equity strategy returned 4.99% gross of fees (4.87% net of fees), outperforming the MSCI EAFE Index’s 2.95% return and MSCI ACWI ex USA Index’s 2.44% return. The portfolio’s outperformance in comparison to the Index can be traced mostly to securities selection, however, allocation effects also had a favorable impact. In addition, you can check the top 5 holdings of the fund to know its best picks in 2023.

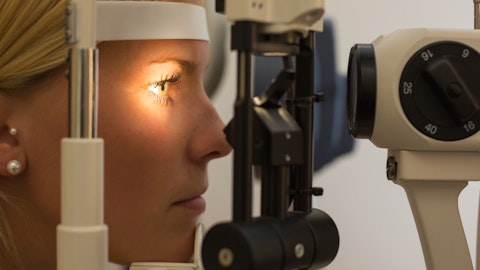

Aristotle Capital’s International Equity strategy highlighted stocks like Alcon Inc. (NYSE:ALC) in the second quarter 2023 investor letter. Headquartered in Geneva, Switzerland, Alcon Inc. (NYSE:ALC) engages in the research, development, manufacturing, and distribution of eye care products. On August 30, 2023, Alcon Inc. (NYSE:ALC) stock closed at $84.73 per share. One-month return of Alcon Inc. (NYSE:ALC) was 3.32%, and its shares gained 27.53% of their value over the last 52 weeks. Alcon Inc. (NYSE:ALC) has a market capitalization of $41.807 billion.

Aristotle Capital’s International Equity strategy made the following comment about Alcon Inc. (NYSE:ALC) in its second quarter 2023 investor letter:

“Alcon Inc. (NYSE:ALC), the eye care devices, equipment and consumables provider, was also a leading contributor during the quarter. In addition to a backdrop of resilient and robust demand across all of its segments, Alcon’s focus on executing its commercial strategy, pricing improvements and product development demonstrates the strength of the business. As an innovative leader in the eye care industry, Alcon develops cutting‐edge products such as Total30, the first reusable lenses using water gradient technology created for astigmatic wearers, and the ARGOS Biometer, which enables surgeons to conduct 3D digital image‐ guided cataract surgery. Products such as these have allowed Alcon to further penetrate its primary end markets and win market share from competitors. While the company continues to navigate challenges such as inflation and supply‐chain inefficiencies, we believe Alcon’s prudent decisions that have helped maintain operational efficiency, its thoughtful approach to acquisitions, and the advantageous industry dynamics highlight the high‐quality nature of the company and the long‐term sustainability of its business model.”

Andrey_Popov/Shutterstock.com

Alcon Inc. (NYSE:ALC) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 25 hedge fund portfolios held Alcon Inc. (NYSE:ALC) at the end of second quarter which was 30 in the previous quarter.

We discussed Alcon Inc. (NYSE:ALC) in another article and shared Madison Investors Fund’s views on the company. In addition, please check out our hedge fund investor letters Q2 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 15 Biggest Startup Failures in the World

- 11 Best Mining Penny Stocks to Buy Now

- 20 Biggest ETFs by Volume

Disclosure: None. This article is originally published at Insider Monkey.