Coatue Management was founded in 1999 by Philippe Laffont, a former understudy of Julian Robertson at Tiger Management. The fund invests mainly in public and private equities from the technology sectors and boasts returns of 443% between 2001 and March 2016. According to regulatory filings, the fund’s equity portfolio carried a market value of $8.15 billion at the end of the third quarter, with 61% of that value being invested in tech stocks and 30% in consumer discretionary stocks.

At Insider Monkey, we estimate a fund manager’s stock picking ability by measuring the performance of a fund’s investments in companies with a market cap in excess of $1 billion. According to this metric, Coatue Management’s stock picks generated an 11.76% return during the third quarter from 52 positions that qualify under those guidelines. In this article we’ll take a close look at four of the fund’s top bets heading into the fourth quarter: Activision Blizzard, Inc. (NASDAQ:ATVI), Facebook Inc (NASDAQ:FB), Netflix, Inc. (NASDAQ:NFLX), and Alphabet Inc (NASDAQ:GOOG).

Activision Blizzard, Inc. (NASDAQ:ATVI) was Coatue Management’s top equity position at the end of the second quarter but, come the end of September, the fund’s management decided to lock in some profits, reducing their position by 16% to 11.6 million shares. According to the fund’s latest 13F filing, this position was worth $513 million at the end of September. Over the course of the third quarter, Activision Blizzard, Inc. (NASDAQ:ATVI) registered an 11.8% advance.

The stock was in the portfolios of 68 hedge funds at the end of the second quarter of 2016, up from 52 hedge funds registered at the end of the previous quarter. The largest stake in Activision Blizzard, Inc. (NASDAQ:ATVI) among them was held by OZ Management, which reported holding $562.4 million worth of stock as of the end of June, with Coatue Management holding the second-most valuable position. Other investors bullish on the company included Egerton Capital Limited, Lone Pine Capital, and Citadel Investment Group.

Follow Activision Blizzard Inc. (NASDAQ:ATVI)

Follow Activision Blizzard Inc. (NASDAQ:ATVI)

Receive real-time insider trading and news alerts

Coatue Management’s new top dog is Facebook Inc (NASDAQ:FB). During the third quarter, Philippe Laffont and his team boosted their investment in the company by 48% to 6.29 million shares worth some $806.5 million. During the third quarter, Facebook Inc (NASDAQ:FB) registered a positive return of 12.2%.

At the end of the second quarter, Facebook was the second-most popular stock among the funds followed by Insider Monkey. 148 of those hedge funds reported a long position in it as of the end of June, down by 10% from the previous quarter. The largest of those 148 stakes in Facebook Inc (NASDAQ:FB) was held by Viking Global, which reported holding $2.3 billion worth of stock as of June 30. It was followed by Lone Pine Capital with a $1.25 billion position. Other investors bullish on the company included Arrowstreet Capital, Egerton Capital Limited, and Lansdowne Partners.

Follow Meta Platforms Inc. (NASDAQ:META)

Follow Meta Platforms Inc. (NASDAQ:META)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.

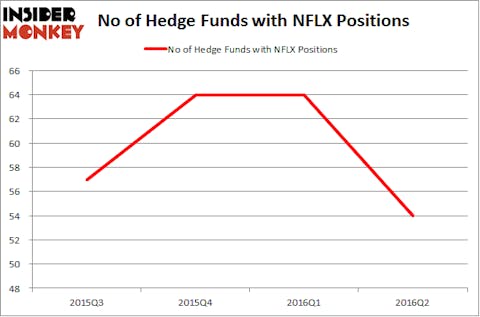

According to regulatory filings, Netflix, Inc. (NASDAQ:NFLX) is one of Coatue Management’s long-term investments, with it having established a long position in the company at the end of 2012. During the third quarter, the fund’s stake was reduced by 4% to 4.74 million shares worth $467 million according to its latest 13F filing. Netflix, Inc. (NASDAQ:NFLX) returned 7.7% during the third quarter and has seen a decrease in activity from the world’s largest hedge funds of late, as seen in the chart below.

The stock was in 54 hedge funds’ portfolios at the end of the second quarter of 2016, down from 64 long positions recorded at the end of the previous quarter. Among these funds, SRS Investment Management held the most valuable stake in Netflix, Inc. (NASDAQ:NFLX), which was worth $932.9 million at the end of the second quarter. On the second spot was Viking Global which amassed $575.3 million worth of shares. Moreover, Matrix Capital Management and Scopia Capital were also bullish on Netflix, Inc. (NASDAQ:NFLX).

Follow Netflix Inc (NASDAQ:NFLX)

Follow Netflix Inc (NASDAQ:NFLX)

Receive real-time insider trading and news alerts

Recent developments at Alphabet Inc (NASDAQ:GOOG) prompted Coatue Management’s leadership to change their opinion about the stock and add it to their shopping list. During the third quarter, the fund’s position was increased by 11% to amass 585,709 shares valued at $455 million at the end of September. Alphabet Inc (NASDAQ:GOOG) registered a 12.3% advance during the third quarter and was the most popular stock among the funds we follow when factoring in the total number of investors owning one or both classes of its shares (187 total).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Eagle Capital Management, managed by Boykin Curry, held the most valuable position in Alphabet Inc (NASDAQ:GOOG). The fund had a $1.28 billion position in the stock, comprising 5.5% of its 13F portfolio at the end of Q2. Sitting at the No. 2 spot was Southeastern Asset Management, run by Mason Hawkins, which held a $669.8 million position. Some other members of the smart money with similar optimism contain John Armitage’s Egerton Capital Limited, Stephen Mandel’s Lone Pine Capital, and Andreas Halvorsen’s Viking Global.

Follow Alphabet Inc. (NASDAQ:GOOG)

Follow Alphabet Inc. (NASDAQ:GOOG)

Receive real-time insider trading and news alerts

Disclosure: None