Polen Capital, an investment management company, released its “Polen U.S. SMID Company Growth Strategy” first-quarter 2023 investor letter. A copy of the same can be downloaded here. The portfolio returned 11.81% gross and 11.49% net of fees in the first quarter compared to a 6.54% return for the Russell 2500 Growth Index. The company believes that focusing on well-positioned high-quality growth companies will help generate superior long-term returns over the next 5 years. In addition, please check the fund’s top five holdings to know its best picks in 2023.

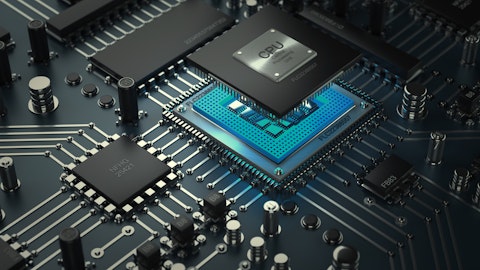

Polen U.S. SMID Company Growth Strategy highlighted stocks like Monolithic Power Systems, Inc. (NASDAQ:MPWR) in the Q1 2023 investor letter. Headquartered in Kirkland, Washington, Monolithic Power Systems, Inc. (NASDAQ:MPWR) designs and develops semiconductor-based power electronics solutions. On May 12, 2023, Monolithic Power Systems, Inc. (NASDAQ:MPWR) stock closed at $399.19 per share. One-month return of Monolithic Power Systems, Inc. (NASDAQ:MPWR) was -17.24%, and its shares lost 4.27% of their value over the last 52 weeks. Monolithic Power Systems, Inc. (NASDAQ:MPWR) has a market capitalization of $19.727 billion.

Polen U.S. SMID Company Growth Strategy made the following comment about Monolithic Power Systems, Inc. (NASDAQ:MPWR) in its Q1 2023 investor letter:

“Monolithic Power Systems, Inc. (NASDAQ:MPWR) is an analog and mixed-signal semiconductor company with a focus on integrating power management functions onto a single chip to reduce total energy consumption in its customers’ systems. The business has a strong track record of steady organic revenue growth that goes counter to the inherent cyclicality in the semiconductor industry. Management has consistently found new applications for its power solutions and has capitalized on the tailwind of electrification that is occurring within the automotive and industrial sectors. We believe a combination of macro-related and cyclical uncertainty in the near term is presenting an opportunity to invest in this competitively advantaged compounder at an attractive valuation currently.”

science photo/Shutterstock.com

Monolithic Power Systems, Inc. (NASDAQ:MPWR) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 30 hedge fund portfolios held Monolithic Power Systems, Inc. (NASDAQ:MPWR) at the end of the fourth quarter, which was 43 in the previous quarter.

We discussed Monolithic Power Systems, Inc. (NASDAQ:MPWR) in another article and shared ClearBridge SMID Cap Growth Strategy’s views on the company. In addition, please check out our hedge fund investor letters Q1 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 15 States With the Biggest Drug Problems in 2023

- 20 Best Cities for Singles in their 30s

- 15 Biggest Potato Chip Brands and Companies in the World

Disclosure: None. This article is originally published at Insider Monkey.