Madison Investments, an investment advisor, released its “Madison Small Cap Fund” third-quarter 2025 investor letter. A copy of the letter can be downloaded here. The third quarter was difficult for the Small Cap Fund. The small-cap index’s performance was broad-based. The Madison Small Cap Fund (class Y) was down 1.3% in the quarter, significantly underperforming the benchmarks. The underperformance was driven by stock selection and exacerbated by a very speculative market. In addition, please check the fund’s top five holdings to know its best picks in 2025.

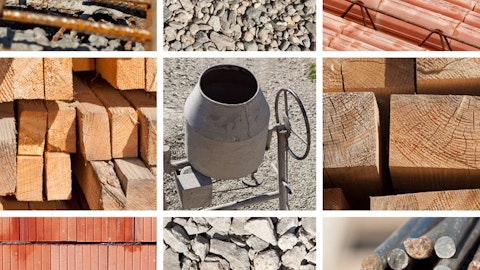

In its third-quarter 2025 investor letter, Madison Small Cap Fund highlighted stocks such as Eagle Materials Inc. (NYSE:EXP). Eagle Materials Inc. (NYSE:EXP) is a heavy construction material and light building materials supplier. The one-month return of Eagle Materials Inc. (NYSE:EXP) was -13.13%, and its shares lost 35.57% of their value over the last 52 weeks. On November 20, 2025, Eagle Materials Inc. (NYSE:EXP) stock closed at $202.52 per share, with a market capitalization of $6.572 billion.

Madison Small Cap Fund stated the following regarding Eagle Materials Inc. (NYSE:EXP) in its third quarter 2025 investor letter:

“Small cap initiated on Eagle Materials Inc. (NYSE:EXP), a leading U.S. manufacturer of heavy construction materials such as Portland cement, concrete, and aggregates, and light building materials such as wallboard and recycled paperboard. We view Eagle as an excellent company with very attractive financial traits. EXP aligns well with our preference for high-quality holdings, given its strong margins, high return on invested capital (ROIC), and return on equity (ROE). With the residential construction cycle in a prolonged downturn, we see this as a timely opportunity to invest in Eagle. Demand for wallboard has been declining for several years, and operating rates for the industry are in the 70s, which means they have a lot of excess capacity. Investors, while somewhat mollified by the resiliency of the business, have lost patience with many construction-exposed names. During the downturn, Eagle has gained market share due to its geographical footprint and cost competitive wallboard assets. Further, we believe we are close to a bottom in residential construction demand, and at this price, we are willing to be patient for the cycle to turn. Management is excellent and allocates capital very judiciously with copious share buybacks. Our current intrinsic value estimate does not assume meaningful margin expansion and has relatively conservative buyback assumptions. We calculate intrinsic value at $269/share.”

Eagle Materials Inc. (NYSE:EXP) is not on our list of 30 Most Popular Stocks Among Hedge Funds. According to our database, 36 hedge fund portfolios held Eagle Materials Inc. (NYSE:EXP) at the end of the second quarter, up from 30 in the previous quarter. In the second quarter of fiscal 2026, Eagle Materials Inc. (NYSE:EXP) recorded a revenue of $639 million, marking 2% increase from the prior year. While we acknowledge the risk and potential of Eagle Materials Inc. (NYSE:EXP) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Eagle Materials Inc. (NYSE:EXP) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Eagle Materials Inc. (NYSE:EXP) and shared a bullish thesis on the company. In addition, please check out our hedge fund investor letters Q3 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.