Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those successful funds in these small-cap stocks. In the following paragraphs, we analyze Vedanta Ltd (ADR) (NYSE:VEDL) from the perspective of those successful funds.

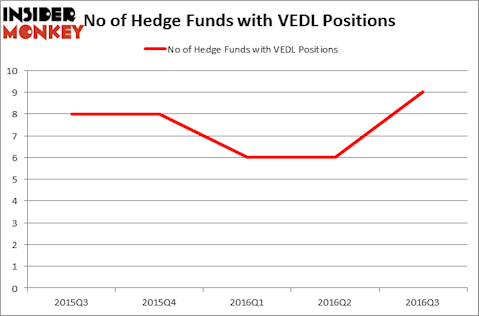

Vedanta Ltd (ADR) (NYSE:VEDL) has seen an increase in hedge fund interest of late. There were nine hedge funds in our database with VEDL positions at the end of the third quarter. At the end of this article we will also compare VEDL to other stocks including Dr. Reddy’s Laboratories Limited (ADR) (NYSE:RDY), iShares NASDAQ Biotechnology Index (ETF) (NASDAQ:IBB), and Packaging Corp Of America (NYSE:PKG) to get a better sense of its popularity.

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

maradon 333/Shutterstock.com

With all of this in mind, let’s go over the new action regarding Vedanta Ltd (ADR) (NYSE:VEDL).

What does the smart money think about Vedanta Ltd (ADR) (NYSE:VEDL)?

At Q3’s end, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, compared to six funds at the end of the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards VEDL over the last 5 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Lakewood Capital Management, led by Anthony Bozza, holds the biggest position in Vedanta Ltd (ADR) (NYSE:VEDL). Lakewood Capital Management has a $8.4 million position in the stock, comprising 0.2% of its 13F portfolio. The second most bullish fund manager is Renaissance Technologies, one of the largest hedge funds in the world, which holds a $6.1 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Other professional money managers that hold long positions include Israel Englander’s Millennium Management, D. E. Shaw’s D E Shaw and Andy Redleaf’s Whitebox Advisors. We should note that Whitebox Advisors is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, some big names were leading the bulls’ herd. Andy Redleaf’s Whitebox Advisors initiated the most outsized position in Vedanta Ltd (ADR) (NYSE:VEDL). Whitebox Advisors had $1.1 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $0.2 million investment in the stock during the quarter. The only other fund with a brand new VEDL position is Richard Driehaus’ Driehaus Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Vedanta Ltd (ADR) (NYSE:VEDL) but similarly valued. These stocks are Dr. Reddy’s Laboratories Limited (ADR) (NYSE:RDY), iShares NASDAQ Biotechnology Index (ETF) (NASDAQ:IBB), Packaging Corp Of America (NYSE:PKG), and Torchmark Corporation (NYSE:TMK). This group of stocks’ market caps are similar to VEDL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RDY | 9 | 421800 | 2 |

| IBB | 23 | 237514 | 5 |

| PKG | 21 | 153584 | 1 |

| TMK | 19 | 614374 | -1 |

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $357 million. That figure was just $22 million in VEDL’s case. iShares NASDAQ Biotechnology Index (ETF) (NASDAQ:IBB) is the most popular stock in this table. On the other hand Dr. Reddy’s Laboratories Limited (ADR) (NYSE:RDY) is the least popular one with only nine bullish hedge fund positions. Compared to these stocks Vedanta Ltd (ADR) (NYSE:VEDL) has the same number of shares as RDY. Considering that hedge funds aren’t fond of this stock in relation to the majority of the other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: none