It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. The Standard and Poor’s 500 Index returned 7.6% over the 12-month period ending November 21, while more than 51% of the constituents of the index underperformed the benchmark. Hence, a random stock picking process will most likely lead to disappointment. At the same time, the 30 most favored mid-cap stocks by the best performing hedge funds monitored by Insider Monkey generated a return of 18% over the same time span. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Team, Inc. (NYSE:TISI) .

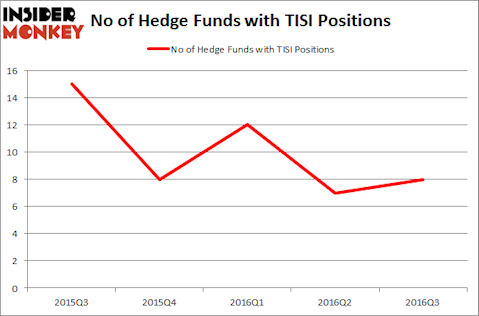

Is Team, Inc. (NYSE:TISI) a bargain? Hedge funds are actually becoming more confident. The number of long hedge fund investments inched up by 1 in recent months. There were 7 hedge funds in our database with TISI holdings at the end of the previous quarter. At the end of this article we will also compare TISI to other stocks including Unit Corporation (NYSE:UNT), Navigant Consulting, Inc. (NYSE:NCI), and Cray Inc. (NASDAQ:CRAY) to get a better sense of its popularity.

Follow Team Inc (NYSE:TISI)

Follow Team Inc (NYSE:TISI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

QiuJu Song/Shutterstock.com

With all of this in mind, let’s take a gander at the recent action regarding Team, Inc. (NYSE:TISI).

Hedge fund activity in Team, Inc. (NYSE:TISI)

Heading into the fourth quarter of 2016, a total of 8 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from the previous quarter. On the other hand, there were a total of 8 hedge funds with a bullish position in TISI at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Ariel Investments, led by John W. Rogers, holds the biggest position in Team, Inc. (NYSE:TISI). Ariel Investments has a $62.7 million position in the stock, comprising 0.8% of its 13F portfolio. The second largest stake is held by Royce & Associates, led by Chuck Royce, holding a $15.3 million position; 0.1% of its 13F portfolio is allocated to the stock. Remaining professional money managers that are bullish contain Mario Gabelli’s GAMCO Investors, Arnaud Ajdler’s Engine Capital and Peter Schliemann’s Rutabaga Capital Management. We should note that Engine Capital is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.