Baron Funds, an investment management company, released its “Baron Opportunity Fund” first quarter 2023 investor letter. A copy of the same can be downloaded here. In the first quarter, the fund outperformed the broader market and increased by 17.96% (Institutional Shares) compared to a 13.85% return for the Russell 3000 Growth Index and a 7.50% return for the S&P 500 Index. In addition, please check the fund’s top five holdings to know its best picks in 2023.

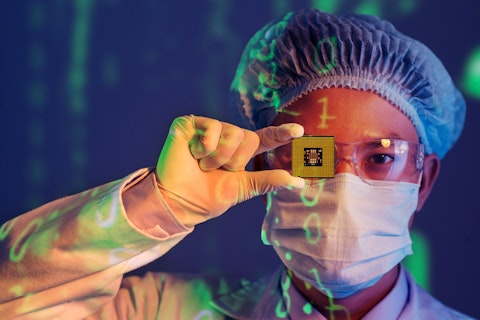

Baron Opportunity Fund highlighted stocks like Marvell Technology, Inc. (NASDAQ:MRVL) in the first quarter 2023 investor letter. Headquartered in Wilmington, Delaware, Marvell Technology, Inc. (NASDAQ:MRVL) offers data infrastructure semiconductor solutions. On May 9, 2023, Marvell Technology, Inc. (NASDAQ:MRVL) stock closed at $39.99 per share. One-month return of Marvell Technology, Inc. (NASDAQ:MRVL) was 1.16%, and its shares lost 23.89% of their value over the last 52 weeks. Marvell Technology, Inc. (NASDAQ:MRVL) has a market capitalization of $34.358 billion.

Baron Opportunity Fund made the following comment about Marvell Technology, Inc. (NASDAQ:MRVL) in its Q1 2023 investor letter:

“We took advantage of weakness to purchase shares of Marvell Technology, Inc. (NASDAQ:MRVL), a leading supplier of infrastructure semiconductor solutions that enable the rapid and efficient movement of data throughout the broader data economy, from the data center core to the network edge. Through both organic development and acquisitions led by CEO Matt Murphy since he took over in 2016, Marvell has built a portfolio of market-leading products and IP across computing, networking, security, electro-optics, and storage. Consequently, the company is a critical partner for hyperscale cloud service provider, data center, enterprise networking, carrier infrastructure, consumer, and automotive/industrial end-market customers. Marvell is targeting 15% to 20% average revenue growth through the semiconductor cycle in the coming years, largely driven by secular trends and company-specific product innovations within the cloud, 5G, and automotive end markets. We believe Marvell can deliver on or exceed this target because, among other growth opportunities, its market-leading optical products are critical to delivering increasing data transmission speeds required by hyperscale customers in AI training and inference. At the same time, the company is simultaneously ramping up a custom silicon business working directly with hyperscale partners. Given the dislocation in the stock on near-term cyclical concerns, we believe we paid an attractive price for the long-term growth of this industry-leading company.”

Dragon Images/Shutterstock.com

Marvell Technology, Inc. (NASDAQ:MRVL) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 58 hedge fund portfolios held Marvell Technology, Inc. (NASDAQ:MRVL) at the end of the fourth quarter which was 58 in the previous quarter.

We discussed Marvell Technology, Inc. (NASDAQ:MRVL) in another article and shared the list of best 5G stocks to buy. In addition, please check out our hedge fund investor letters Q1 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 20 Biggest Cybersecurity Companies In the World

- 11 Best Data Center Stocks to Buy Now

- 10 Biggest Clothing and Footwear Manufacturers

Disclosure: None. This article is originally published at Insider Monkey.