Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in October due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 30 S&P 500 stocks among hedge funds at the end of September 2018 returned an average of 6.7% through November 15th whereas the S&P 500 Index ETF gained only 2.6% during the same period. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at Intuit Inc. (NASDAQ:INTU) from the perspective of those elite funds.

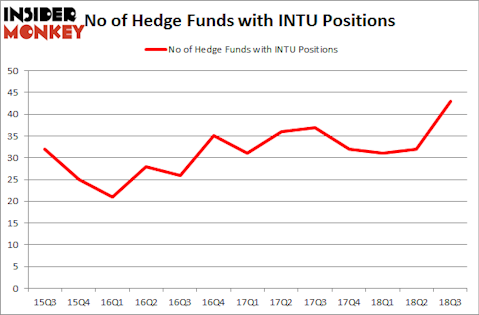

Is Intuit Inc. (NASDAQ:INTU) a buy, sell, or hold? Money managers are becoming hopeful. The number of long hedge fund positions inched up by 11 lately. Our calculations also showed that INTU isn’t among the 30 most popular stocks among hedge funds. INTU was in 43 hedge funds’ portfolios at the end of the third quarter of 2018. There were 32 hedge funds in our database with INTU holdings at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

Let’s check out the latest hedge fund action surrounding Intuit Inc. (NASDAQ:INTU).

What have hedge funds been doing with Intuit Inc. (NASDAQ:INTU)?

Heading into the fourth quarter of 2018, a total of 43 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 34% from the second quarter of 2018. By comparison, 32 hedge funds held shares or bullish call options in INTU heading into this year. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the biggest position in Intuit Inc. (NASDAQ:INTU), worth close to $717.3 million, comprising 1.6% of its total 13F portfolio. The second largest stake is held by John Overdeck and David Siegel of Two Sigma Advisors, with a $295 million position; the fund has 0.7% of its 13F portfolio invested in the stock. Remaining peers that are bullish contain Cliff Asness’s AQR Capital Management, Israel Englander’s Millennium Management and PVH’s Renaissance Technologies.

Now, key money managers have been driving this bullishness. Renaissance Technologies, managed by Jim Simons, created the most outsized position in Intuit Inc. (NASDAQ:INTU). Renaissance Technologies had $109.7 million invested in the company at the end of the quarter. Zach Schreiber’s Point State Capital also initiated a $25.6 million position during the quarter. The other funds with brand new INTU positions are Ian Simm’s Impax Asset Management, Paul Tudor Jones’s Tudor Investment Corp, and Benjamin A. Smith’s Laurion Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Intuit Inc. (NASDAQ:INTU) but similarly valued. We will take a look at UBS Group AG (NYSE:UBS), Colgate-Palmolive Company (NYSE:CL), CME Group Inc (NASDAQ:CME), and Vodafone Group Plc (NASDAQ:VOD). This group of stocks’ market valuations resemble INTU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UBS | 14 | 928425 | -1 |

| CL | 33 | 1739318 | 3 |

| CME | 53 | 2018368 | 5 |

| VOD | 18 | 944408 | 0 |

| Average | 29.5 | 1407630 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.41 billion. That figure was $2.39 billion in INTU’s case. CME Group Inc (NASDAQ:CME) is the most popular stock in this table. On the other hand UBS Group AG (NYSE:UBS) is the least popular one with only 14 bullish hedge fund positions. Intuit Inc. (NASDAQ:INTU) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CME might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.