Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Valeant and SunEdison, have not done well during the last 12 months due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average. The top 30 mid-cap stocks (market caps between $1 billion and $10 billion) among hedge funds delivered an average return of 18% during the last four quarters. S&P 500 Index returned only 7.6% during the same period and less than 49% of its constituents managed to beat this return. Because their consensus picks have done well, we pay attention to what elite funds and billionaire investors think before doing extensive research on a stock. In this article, we will take a closer look at Harman International Industries Inc /DE/ (NYSE:HAR) from the perspective of those elite funds.

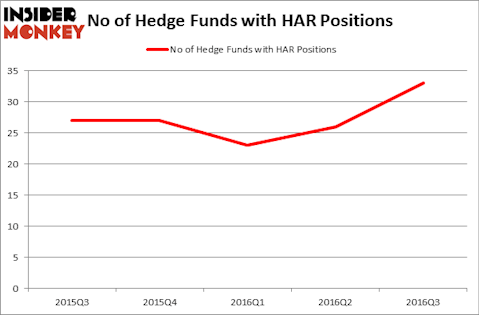

So, is Harman International Industries Inc/DE/ (NYSE:HAR) a healthy stock for your portfolio? Hedge funds seem to be in a bullish mood. During the third quarter, the number of funds tracked by Insider Monkey long Harman International Industries advanced by seven to 33. At the end of this article we will also compare HAR to other stocks including Panera Bread Co (NASDAQ:PNRA), RenaissanceRe Holdings Ltd. (NYSE:RNR), and Old Republic International Corporation (NYSE:ORI) to get a better sense of its popularity.

Follow Harman International Industries Inc (NYSE:HAR)

Follow Harman International Industries Inc (NYSE:HAR)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

solarseven/Shutterstock.com

With all of this in mind, we’re going to take a gander at the new action encompassing Harman International Industries Inc/DE/ (NYSE:HAR).

How are hedge funds trading Harman International Industries Inc/DE/ (NYSE:HAR)?

A total of 33 funds tracked by Insider Monkey held long positions in Harman International Industries, up by 27% over the quarter. With the smart money’s capital changing hands, there exists a few noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Alexander Roepers’ Atlantic Investment Management has the biggest position in Harman International Industries Inc./DE/ (NYSE:HAR), worth close to $135.9 million, comprising 17.7% of its total 13F portfolio. The second most bullish fund is John W. Rogers’ Ariel Investments, with a $106.7 million position; the fund has 1.3% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that are bullish include Sandy Nairn’s Edinburgh Partners and Martin Whitman’s Third Avenue Management.