Hardman Johnston Global Advisors, an investment management company, released its “Hardman Johnston Global Equity Strategy” investor letter for the third quarter of 2025. A copy of the letter can be downloaded here. The portfolio underperformed in the quarter due to stock selection. The composite returned 5.02%, net of fees, compared to 7.62% for the MSCI AC World Net Index. In addition, please check the fund’s top five holdings to know its best picks in 2025.

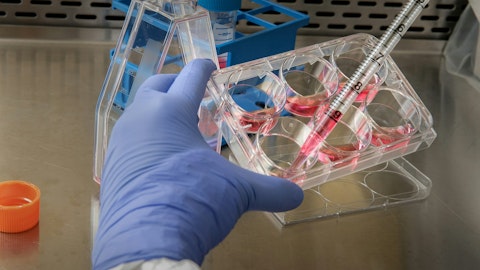

In its third-quarter 2025 investor letter, Hardman Johnston Global Equity Strategy highlighted stocks such as Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX). Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) is a biotechnology company focusing on developing and commercializing therapies for treating cystic fibrosis (CF). The one-month return of Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) was 8.76%, and its shares gained 15.91% of their value over the last 52 weeks. On December 26, 2025, Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) stock closed at $462.90 per share, with a market capitalization of $118.683 billion.

Hardman Johnston Global Equity Strategy stated the following regarding Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) in its third quarter 2025 investor letter:

“Within Health Care, Boston Scientific Corp. and Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) were the largest drivers of underperformance. The Trump administration announced a Section 232 tariff investigation into medical devices increasing macro uncertainty. After conversations with the FDA, Vertex Pharmaceuticals Inc. ended pursuit of a broad chronic neuropathic pain label for Journavx, limiting chronic pain TAM. Chronic pain remains a very large multi-billion-dollar TAM. Journavx is approved and launching in acute pain with positive initial indications. Along with the disappointing chronic pain update, VX-993 (next-generation pain asset) failed in phase II development. Vertex has multiple other back up pain agents in development but both updates pressured the stock. Outside of pain franchise, all other updates were positive with steady progress in inaxaplin (APOL-1 mediated kidney disease), povetacicept (IgA nephropathy), VX 880 (type 1 diabetes), and Casgevy (gene-editing therapy). Alyftrek (next generation cystic fibrosis triple) launch is under way and patients are switching from Trikafta to Alyftrek. Alyftrek carries a lower royalty burden than Trikafta. Improving margins and growing duration of therapy for cystic fibrosis (CF) patients are key to continuing growth of CF franchise. We remain confident in Vertex’s long-term outlook, supported by its high-margin CF franchise, strong balance sheet, and a pipeline with multiple late-stage, multi-billion-dollar opportunities.”

Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 61 hedge fund portfolios held Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) at the end of the third quarter, which was 53 in the previous quarter. Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) delivered $3.08 billion in revenue in the third quarter, representing a 11% growth compared to Q3 2024. While we acknowledge the risk and potential of Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) and shared Harding Loevner Global Equity Strategy’s views on the company. In addition, please check out our hedge fund investor letters Q3 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.