There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Prospect Capital Corporation (NASDAQ:PSEC) .

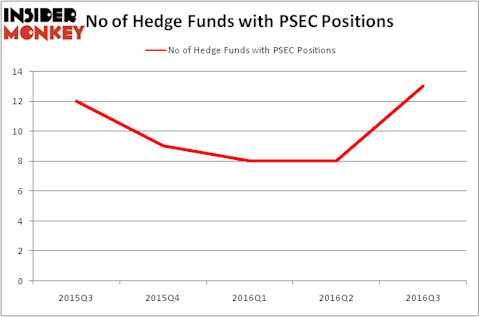

Prospect Capital Corporation (NASDAQ:PSEC) investors should be aware of an increase in hedge fund sentiment lately. There were 13 hedge funds in our database with PSEC positions at the end of September. At the end of this article we will also compare PSEC to other stocks including Chicago Bridge & Iron Company N.V. (NYSE:CBI), Littelfuse, Inc. (NASDAQ:LFUS), and Zendesk Inc (NYSE:ZEN) to get a better sense of its popularity.

Follow Prospect Capital Corp (NASDAQ:PSEC)

Follow Prospect Capital Corp (NASDAQ:PSEC)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

conejota/Shutterstock.com

Keeping this in mind, let’s take a look at the new action surrounding Prospect Capital Corporation (NASDAQ:PSEC).

How are hedge funds trading Prospect Capital Corporation (NASDAQ:PSEC)?

Heading into the fourth quarter of 2016, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in Prospect Capital Corporation (NASDAQ:PSEC), which represents an increase of 63% from one quarter earlier. On the other hand, there were a total of nine funds with a bullish position in PSEC at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, D E Shaw & Co., one of the largest hedge funds in the world holds the biggest position in Prospect Capital Corporation (NASDAQ:PSEC). D E Shaw has a $4.1 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second most bullish fund manager is McKinley Capital Management, led by Robert B. Gillam, which holds a $4.1 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining members of the smart money that are bullish comprise John Overdeck and David Siegel’s Two Sigma Advisors, Matt Sirovich and Jeremy Mindich’s Scopia Capital and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, key hedge funds have jumped into Prospect Capital Corporation (NASDAQ:PSEC) headfirst. Citadel Investment Group, led by Ken Griffin, assembled the largest call position in Prospect Capital Corporation (NASDAQ:PSEC). Citadel Investment Group had $0.8 million invested in the company at the end of the quarter. Joshua Packwood and Schuster Tanger’s Radix Partners also initiated a $0.4 million position during the quarter. The other funds with brand new PSEC positions are Matthew Tewksbury’s Stevens Capital Management, Israel Englander’s Millennium Management, and Alec Litowitz and Ross Laser’s Magnetar Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Prospect Capital Corporation (NASDAQ:PSEC) but similarly valued. We will take a look at Chicago Bridge & Iron Company N.V. (NYSE:CBI), Littelfuse, Inc. (NASDAQ:LFUS), Zendesk Inc (NYSE:ZEN), and United Bankshares, Inc. (NASDAQ:UBSI). All of these stocks’ market caps match PSEC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CBI | 27 | 337140 | -3 |

| LFUS | 14 | 178544 | 0 |

| ZEN | 26 | 308682 | -1 |

| UBSI | 8 | 38600 | 2 |

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $216 million. That figure was just $15 million in PSEC’s case. Chicago Bridge & Iron Company N.V. (NYSE:CBI) is the most popular stock in this table. On the other hand United Bankshares, Inc. (NASDAQ:UBSI) is the least popular one with only eight funds having reported long positions. Prospect Capital Corporation (NASDAQ:PSEC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Chicago Bridge & Iron Company N.V. (NYSE:CBI) might be a better candidate to consider taking a long position in.

Disclosure: none