Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts usually don’t make them change their opinion towards a company. This time it may be different. The coronavirus pandemic destroyed the high correlations among major industries and asset classes. We are now in a stock pickers market where fundamentals of a stock have more effect on the price than the overall direction of the market. As a result we observe sudden and large changes in hedge fund positions depending on the news flow. Let’s take a look at the hedge fund sentiment towards CF Industries Holdings, Inc. (NYSE:CF) to find out whether there were any major changes in hedge funds’ views.

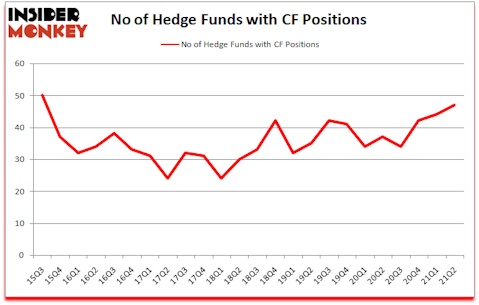

Is CF Industries Holdings, Inc. (NYSE:CF) a healthy stock for your portfolio? Money managers were becoming hopeful. The number of long hedge fund bets advanced by 3 lately. CF Industries Holdings, Inc. (NYSE:CF) was in 47 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 50. Our calculations also showed that CF isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). There were 44 hedge funds in our database with CF positions at the end of the first quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Hedge funds have more than $3.5 trillion in assets under management, so you can’t expect their entire portfolios to beat the market by large margins. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 79 percentage points since March 2017 (see the details here). So you can still find a lot of gems by following hedge funds’ moves today.

Zilvinas Mecelis of Covalis Capital

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to review the recent hedge fund action encompassing CF Industries Holdings, Inc. (NYSE:CF).

Do Hedge Funds Think CF Is A Good Stock To Buy Now?

At Q2’s end, a total of 47 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from the first quarter of 2020. The graph below displays the number of hedge funds with bullish position in CF over the last 24 quarters. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

More specifically, Glendon Capital Management was the largest shareholder of CF Industries Holdings, Inc. (NYSE:CF), with a stake worth $217.9 million reported as of the end of June. Trailing Glendon Capital Management was D E Shaw, which amassed a stake valued at $111.5 million. Castle Hook Partners, Anomaly Capital Management, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Glendon Capital Management allocated the biggest weight to CF Industries Holdings, Inc. (NYSE:CF), around 14.1% of its 13F portfolio. Brightline Capital is also relatively very bullish on the stock, setting aside 9 percent of its 13F equity portfolio to CF.

Consequently, some big names have jumped into CF Industries Holdings, Inc. (NYSE:CF) headfirst. Covalis Capital, managed by Zilvinas Mecelis, initiated the biggest position in CF Industries Holdings, Inc. (NYSE:CF). Covalis Capital had $19.9 million invested in the company at the end of the quarter. Stanley Druckenmiller’s Duquesne Capital also made a $10 million investment in the stock during the quarter. The other funds with brand new CF positions are Alexander Mitchell’s Scopus Asset Management, Noam Gottesman’s GLG Partners, and Andrew Sandler’s Sandler Capital Management.

Let’s now review hedge fund activity in other stocks similar to CF Industries Holdings, Inc. (NYSE:CF). We will take a look at Intellia Therapeutics, Inc. (NASDAQ:NTLA), Darling Ingredients Inc. (NYSE:DAR), Lightspeed Commerce Inc. (NYSE:LSPD), Repligen Corporation (NASDAQ:RGEN), ICON Public Limited Company (NASDAQ:ICLR), Magellan Midstream Partners, L.P. (NYSE:MMP), and Teva Pharmaceutical Industries Limited (NYSE:TEVA). All of these stocks’ market caps resemble CF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NTLA | 41 | 2282192 | 12 |

| DAR | 41 | 839147 | 8 |

| LSPD | 29 | 649487 | 8 |

| RGEN | 35 | 1285346 | -3 |

| ICLR | 39 | 1301455 | 10 |

| MMP | 13 | 89137 | -1 |

| TEVA | 22 | 947100 | -2 |

| Average | 31.4 | 1056266 | 4.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.4 hedge funds with bullish positions and the average amount invested in these stocks was $1056 million. That figure was $956 million in CF’s case. Intellia Therapeutics, Inc. (NASDAQ:NTLA) is the most popular stock in this table. On the other hand Magellan Midstream Partners, L.P. (NYSE:MMP) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks CF Industries Holdings, Inc. (NYSE:CF) is more popular among hedge funds. Our overall hedge fund sentiment score for CF is 86.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 22.9% in 2021 through October 1st but still managed to beat the market by 5.6 percentage points. Hedge funds were also right about betting on CF as the stock returned 19.6% since the end of June (through 10/1) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Cf Industries Holdings Inc. (NYSE:CF)

Follow Cf Industries Holdings Inc. (NYSE:CF)

Receive real-time insider trading and news alerts

Suggested Articles:

- Best and Worst Dating Apps in 2021

- 11 Best Lithium and Battery Stocks To Buy

- 10 Best Online Brokers for Non-US Residents

Disclosure: None. This article was originally published at Insider Monkey.