Investors do not wait. Get ready for Active Management now!

Now is the time for investors to incorporate quantitative tools to empower their portfolio management. Any change in the direction of any of the principal components of earnings growth such as sales growth, gross margins, operating or financing costs may be important indicators about the future direction of the growth rate of the company. Intuit Inc. (NASDAQ:INTU) is exhibiting a clear sell pattern.

Andrey_Popov/Shutterstock.com

How to Spot a Loser!

- High & flat to falling gross margin

- Low & flat to rising SG&A and interest costs

- Lower sales growth

- Rising inventories & receivables

- Extended share price

- Extended valuation

Intuit Inc. $288.110 SELL this rich company getting worse

Intuit Inc. has been an exceptionally profitable company with persistently high cash return on total capital of 29.7% on average over the past 21 years. Over the long term the shares of Intuit have advanced by 387% relative to the broad market index.

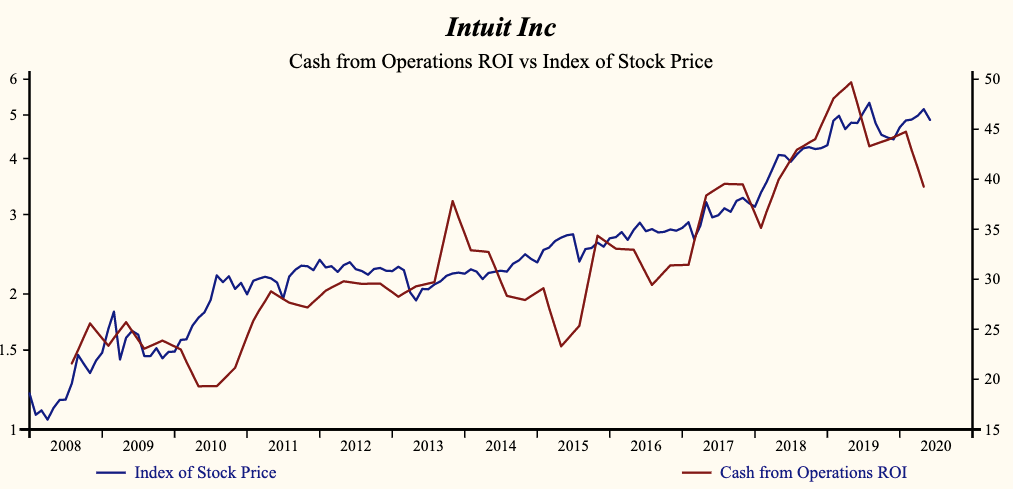

The shares have been very highly correlated with trends in Growth Factors. The dominant factor in the Growth group is Cash from Operations ROI which has been 91% correlated with the share price with a one quarter lead.

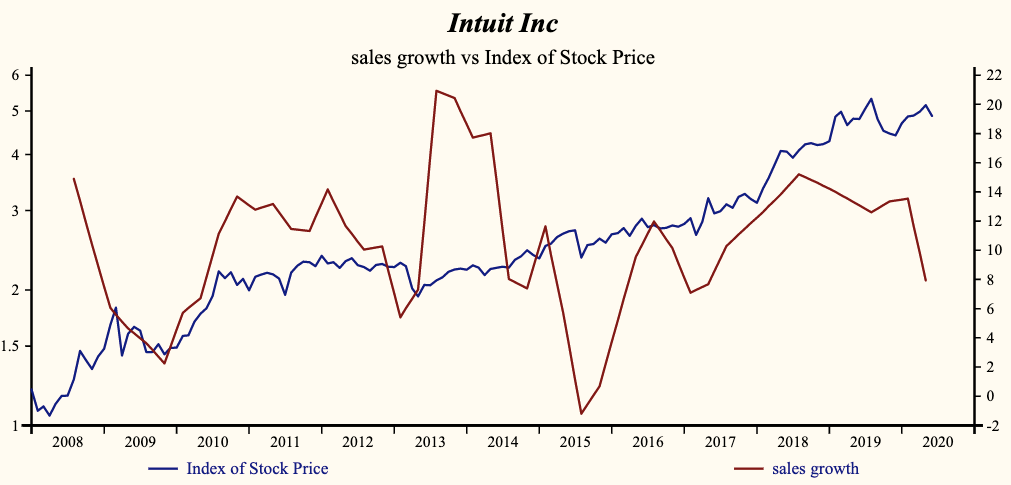

Currently, sales growth is 7.9% which is low in the record of the company and lower than last quarter.

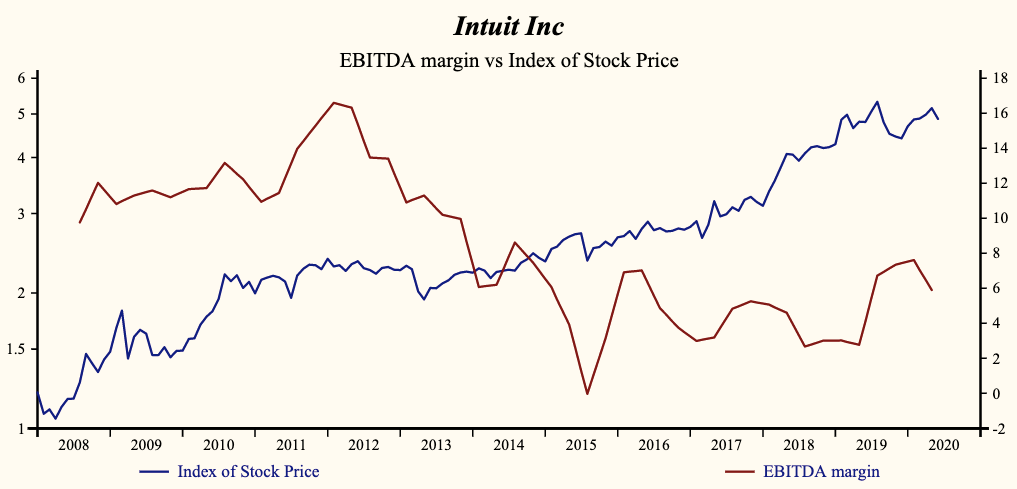

The company is recording a high and falling gross profit margin. Costs have been falling steadily for the past 2 years but SG&A Expenses increased suddenly in the last quarter. This reversal is significant since reducing cost has been key in supporting the bottom line. SG&A expenses reductions are not limitless and that implies that the company has limited scope for further cost containment. The pressure on profit margins is evident by the sudden drop last quarter in the EBITDA growth rate relative to sales. Interest costs are at the lowest point in the record of the company and still falling. This continuous reduction in interest costs has also been supporting cash flow and EBITDA growth and ultimately Free Cash Flow growth.

Time to Cash Out of Intuit

The current indicated annual dividend produces a yield of 0.7%. Five-year average dividend growth is 16.1%. Current trailing operating cash-flow coverage of the dividend is 3.7 times. More recently, the shares of Intuit have advanced by 138% since the May, 2013 low. The shares are trading at upper-end of the volatility range in an 85-month rising relative share price trend. The current extended share price provides a good opportunity to sell the shares of this evidently decelerating company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.