While the market driven by short-term sentiment influenced by uncertainty regarding the future of the interest rate environment in the US, declining oil prices and the trade war with China, many smart money investors are keeping their optimism regarding the current bull run, while still hedging many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Sandy Spring Bancorp Inc. (NASDAQ:SASR).

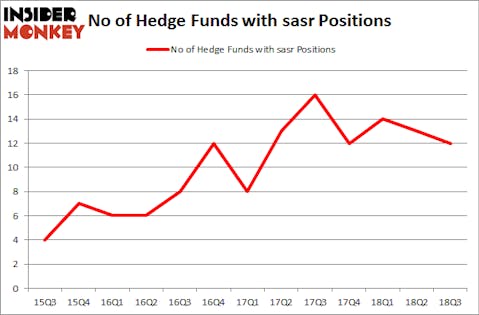

Sandy Spring Bancorp Inc. (NASDAQ:SASR) has experienced a decrease in support from the world’s most elite money managers of late. SASR was in 12 hedge funds’ portfolios at the end of September. There were 13 hedge funds in our database with SASR holdings at the end of the previous quarter. Our calculations also showed that sasr isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

We’re going to take a look at the key hedge fund action regarding Sandy Spring Bancorp Inc. (NASDAQ:SASR).

How are hedge funds trading Sandy Spring Bancorp Inc. (NASDAQ:SASR)?

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of -8% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SASR over the last 13 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

The largest stake in Sandy Spring Bancorp Inc. (NASDAQ:SASR) was held by Renaissance Technologies, which reported holding $37.6 million worth of stock at the end of September. It was followed by Forest Hill Capital with a $19.5 million position. Other investors bullish on the company included Millennium Management, AQR Capital Management, and EJF Capital.

Due to the fact that Sandy Spring Bancorp Inc. (NASDAQ:SASR) has faced declining sentiment from the entirety of the hedge funds we track, logic holds that there exists a select few funds who sold off their positions entirely last quarter. At the top of the heap, Noam Gottesman’s GLG Partners dumped the largest position of the 700 funds watched by Insider Monkey, comprising close to $8.5 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund dropped about $0.5 million worth. These moves are intriguing to say the least, as total hedge fund interest dropped by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Sandy Spring Bancorp Inc. (NASDAQ:SASR) but similarly valued. These stocks are Web.com Group, Inc. (NASDAQ:WEB), Continental Building Products Inc (NYSE:CBPX), Interface, Inc. (NASDAQ:TILE), and Kite Realty Group Trust (NYSE:KRG). All of these stocks’ market caps are closest to SASR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WEB | 24 | 481203 | 1 |

| CBPX | 18 | 115523 | -2 |

| TILE | 17 | 96988 | -1 |

| KRG | 13 | 32991 | 1 |

| Average | 18 | 181676 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $182 million. That figure was $91 million in SASR’s case. Web.com Group, Inc. (NASDAQ:WEB) is the most popular stock in this table. On the other hand Kite Realty Group Trust (NYSE:KRG) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Sandy Spring Bancorp Inc. (NASDAQ:SASR) is even less popular than KRG. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.