Sands Capital, an investment management company, released its “Sands Capital Technology Innovators Fund” Q2 2025 investor letter. A copy of the letter can be downloaded here. Technology Innovators focus on pioneering businesses worldwide that serve as key drivers or beneficiaries of significant long-term changes driven by technology. The fund returned 26.0% (net) in the second quarter compared to a 21.9% return for the benchmark, MSCI ACWI Info Tech and Communication Services Index. Easing geopolitical concerns, renewed AI optimism, resilient macroeconomic data, strong corporate earnings, and technical tailwinds boosted the markets for a quick recovery in the quarter. You can check the fund’s top 5 holdings to know more about its best picks for 2025.

In its second-quarter 2025 investor letter, Sands Capital Technology Innovators Fund highlighted stocks such as Global-E Online Ltd. (NASDAQ:GLBE). Global-E Online Ltd. (NASDAQ:GLBE) is a direct-to-consumer cross-border e-commerce platform. Global-E Online Ltd. (NASDAQ:GLBE) shares returned 4.42% over the past month and experienced a 1.58% decline over the last 12 months. On July 24, 2025, Global-E Online Ltd. (NASDAQ:GLBE) stock closed at $34.27 per share, with a market capitalization of $5.817 billion.

Sands Capital Technology Innovators Fund stated the following regarding Global-E Online Ltd. (NASDAQ:GLBE) in its second quarter 2025 investor letter:

“We sold Global-E Online Ltd. (NASDAQ:GLBE) due to cybersecurity and execution concerns that may derail the business’ ability to sustain the strong growth we expected. In recent months, three large customers have been hacked, resulting in significant operational challenges. While it’s possible that these attacks were strictly due to vulnerabilities with third party vendors, it would be a material risk to the business and stock if Global-e was implicated. This risk is exacerbated by the challenges higher tariffs may pose to its business, given its role in facilitating cross-border ecommerce. We still see a significant potential for the business, but these unforeseen challenges led us to exit the position in favor of higher conviction opportunities.”

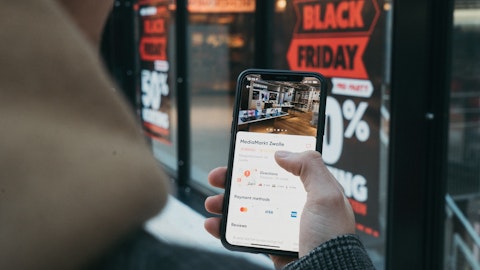

A shopper browsing through products online from the comfort of their home.

Global-E Online Ltd. (NASDAQ:GLBE) is not on our list of 30 Most Popular Stocks Among Hedge Funds. According to our database, 32 hedge fund portfolios held Global-E Online Ltd. (NASDAQ:GLBE) at the end of the first quarter compared to 31 in the previous quarter. Global-E Online Ltd. (NASDAQ:GLBE) ended the first quarter 2025 with revenues of nearly $190 million, up 30% year-over-year. While we acknowledge the risk and potential of Global-E Online Ltd. (NASDAQ:GLBE) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Global-E Online Ltd. (NASDAQ:GLBE) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In addition, please check out our hedge fund investor letters Q2 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.