Over the past few years SandRidge Energy Inc. (NYSE:SD) has undergone several transitions, which has dramatically altered the company and in some ways clouded its investment picture. In an effort to simplify the investment thesis, I’ve distilled everything down to three reasons why you’d buy shares of the company.

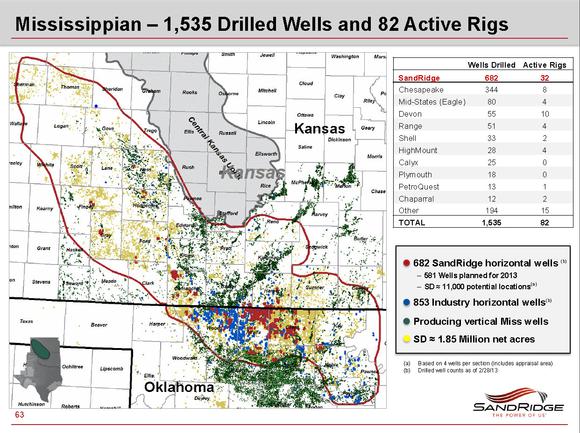

1. SandRidge is the top lease holder and most active driller in the Mississippi Lime formation. The central thesis to an investment in SandRidge Energy Inc. (NYSE:SD) is your belief in the company’s Mississippian growth plan. While the company has operations in the shallow water of the Gulf of Mexico and the West Texas Overthrust, SandRidge is virtually synonymous with the Mississippian. It has twice the wells as its closest competitor, Chesapeake Energy Corporation (NYSE:CHK). It’s running three times the number of drilling rigs as Devon Energy Corp (NYSE:DVN). As you can see in the slide from a recent SandRidge Energy Inc. (NYSE:SD) investor presentation below, the company is simply head-and-shoulders above its competitors in the play:

Source: SandRidge Energy Investor Presentation

The company has also spent nearly half a billion dollars to build out its own saltwater disposal system and it’s even installed its own electrical grid. It’s done all this in an effort to get its well costs down as low as possible. These wells, which produce on average 45% oil and natural gas liquids along with 55% natural gas, yield a very high rate of return for the company. That rate is increased thanks to the aforementioned infrastructure investments.

The rest of the energy industry is beginning to take notice of the play’s potential. Phillips 66 (NYSE:PSX) recently signed a deal to get Mississippian oil shipped to a local refinery. When added to SandRidge Energy Inc. (NYSE:SD)’s recent percent-of-proceeds natural gas liquids contract with Atlas Pipeline Partners, L.P. (NYSE:APL) we’re beginning to see some validation of the Mississippian’s tremendous potential for SandRidge.

2. The company has improved its financial position and its capital plan is fully funded through 2014 with multiple options to fund its plan through 2015. Like most of the smaller oil and natural gas exploration and production companies, SandRidge has more potential for growth than it can fund through its current cash flow. That’s forced the company to sell assets, including the recent sale of its Permian Basin acreage. That deal provided enough capital to enable the company to pay down its debt, while fully funding its capital plans through the end of next year. The company has a variety of options to access additional funding which puts it on very solid financial footing for the first time in years.

3. SandRidge grew its Mississippian production 131% year over year while also growing its oil reserves by 35%. The company’s investments in the Mississippian are beginning to pay off with visible production growth. Last year the company more than doubled its production in the play. Meanwhile, it was also able to grow its overall oil reserves by 35%.

The company sees its Mississippian oil and liquids production jumping another 78% in the year ahead, with overall production up 72%. This liquids-focused growth is important given that 80% of its Mississippian cash flows come from oil production. However, if natural gas prices continue to rise, there is potential here for some significant upside given the natural gas production that is coming out of the Mississippian.

The bottom line here is that you’re investing in SandRidge Energy Inc. (NYSE:SD) because you believe in the future of the Mississippian. While that is an important part of the story, it’s by no means the whole story.

If you’d like read more of the story and learn more about the future of this emerging oil and gas junior then check out The Motley Fool’s premium research report detailing SandRidge Energy Inc. (NYSE:SD)’s game plan. To get started, simply click here now!

The article 3 Reasons to Buy SandRidge Energy originally appeared on Fool.com and is written by Matt DiLallo.

Fool contributor Matt DiLallo owns shares of Phillips 66. The Motley Fool owns shares of Devon Energy and has the following options: Long Jan 2014 $20 Calls on Chesapeake Energy, Long Jan 2014 $30 Calls on Chesapeake Energy, and Short Jan 2014 $15 Puts on Chesapeake Energy. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.