Polen Capital, an investment management company, released its “Polen U.S. Small Company Growth Strategy” first-quarter 2025 investor letter. A copy of the letter can be downloaded here. In Q1 2025, optimism fueled by the Trump election shifted to fear and uncertainty due to apprehension about cost-cutting measures and emerging trade policies. In the first quarter, the fund delivered -10.53% gross, and -10.83% net of fees, compared to a -11.12% return for the Russell 2000 Growth Index. In addition, you can check the fund’s top 5 holdings to find out its best picks for 2025.

In its first-quarter 2025 investor letter, Polen U.S. Small Company Growth Strategy highlighted stocks such as Revolve Group, Inc. (NYSE:RVLV). Revolve Group, Inc. (NYSE:RVLV) is an online fashion retailer for millennial and Generation Z consumers. The one-month return of Revolve Group, Inc. (NYSE:RVLV) was 1.73%, and its shares lost 11.77% of their value over the last 52 weeks. On May 13, 2025, Revolve Group, Inc. (NYSE:RVLV) stock closed at $20.32 per share with a market capitalization of $1.45 billion.

Polen U.S. Small Company Growth Strategy stated the following regarding Revolve Group, Inc. (NYSE:RVLV) in its Q1 2025 investor letter:

“The most significant quarterly detractors from performance, both relative and absolute, were Globant, e.l.f. Beauty, and Revolve Group.

Revolve Group, an online apparel retailer targeting Millennials and Gen Z, gave back some of its solid 2024 performance (+102%) this quarter on concerns that tariff-related economic weakness could add to already weak consumer discretionary spending. Nothing has changed regarding the company’s differentiated data-driven merchandising model and innovative marketing methods, which have established Revolve as a premium fashion destination. The company is led by a highly skilled management team that takes a disciplined, long-term-oriented approach to all aspects of the business.”

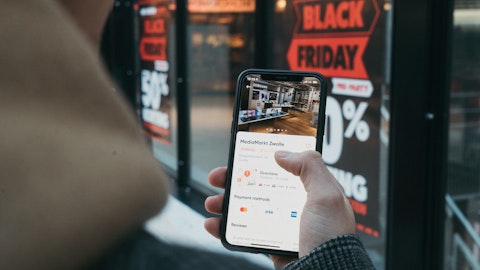

A modern fashion boutique lit up with neon display signs.

Revolve Group, Inc. (NYSE:RVLV) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 24 hedge fund portfolios held Revolve Group, Inc. (NYSE:RVLV) at the end of the fourth quarter compared to 18 in the third quarter. In the first quarter, Revolve Group, Inc. (NYSE:RVLV) reported net sales of $297 million, marking a 10% increase from Q1 2024. While we acknowledge the potential of Revolve Group, Inc. (NYSE:RVLV) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we covered Revolve Group, Inc. (NYSE:RVLV) and shared The London Company Small Cap Strategy’s views on the company. In addition, please check out our hedge fund investor letters Q1 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.