PulteGroup, Inc. (NYSE:PHM) is putting its money where its mouth is. The company made it clear in recent months that it is going to focus on profitable growth and bury forever the devastation that unprofitable sales caused during the housing collapse. Investors and analysts should have applauded the company’s recent quarterly results. Instead, the shares were discarded and fell more than 14% over a two day stretch just prior to and after the release. This should allow expectations to be reset, momentum accounts to take profits, and set the stage for a new round of out-performance in the shares.

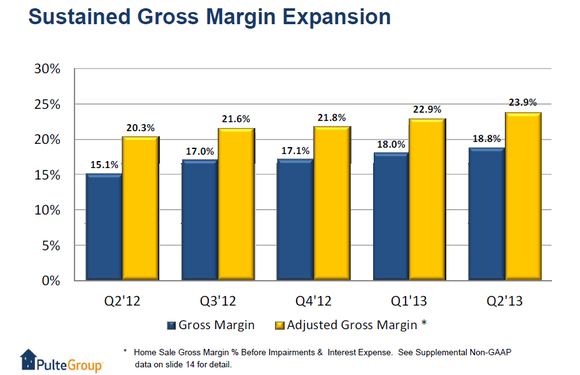

Sales advanced 19% with closings up 9% and average selling prices up 9%. This is good news. But most importantly, gross margins expanded a whopping 360 basis points from the previous year. And to top it all off, the company affirmed its confidence by initiating a dividend for the first time since 2008.

The above facts are reasons why I think the company, which is void of an economic moat, is doing the right things to ensure strong earnings growth and stock performance as the housing recovery unfolds. The stat that sent shares plummeting was orders falling 12% from the prior year. This is part of the company’s strategy and it has communicated this on several occasions, but it had more of an impact than many anticipated. I think it is long-term bullish for the stock to see management say and actually follow through with a strategy focused on profitability and returns on invested capital. The company did highlight one potential risk that bears monitoring- the limited availability of land.

Unprecedented surge in mortgage rates

D.R. Horton, Inc. (NYSE:DHI) faced a similar fate, with the stock dropping more than 8% on what could be construed as a good quarter. Its quarterly EPS of $0.42 actually blew away consensus expectations of $0.34, but order growth scared investors away. Sales grew 46%, but sequential order growth fell 13%. D.R. Horton isn’t going to the same extremes as PulteGroup, Inc. (NYSE:PHM) when it comes to slowing new community growth, so this scared investors.

Management noted that the jump in interest rates played a role. I would certainly expect so. The interest rate on 30-year fixed mortgages jumped more than 100 basis points from the lows- a massive percentage change move. In some ways, results could have been worse. But at the end of the day, there is still a favorable supply/demand balance in housing and historically high affordability levels that reinforce the sustainability of the housing recovery. Mortgage rates won’t be jumping 100 basis points every quarter.

Best of breed

NVR, Inc. (NYSE:NVR) put together a solid quarter as well, but the stock is being pulled down by souring sentiment toward home builders. The stock is down more than 10% from its March high. The company, which operates in 15 states and dominates the Baltimore and Washington, D.C. area, is heralded as maybe the only buy and hold investment option in the space. The company generates by far the best ROIC numbers and knows how to profit over a cycle.