Jim Heppelmann: Yes. Okay. You’ve got a couple of different questions for me there. Let me say, the wildcard Jay is what happens with the economy. There’s nothing again structurally happening that would cause our share gain or our seat growth to differ from the trend as it has been other than just a macro slowdown. And in the past, like in 2020, when there was a macro slowdown then we had an acceleration on the back end of it. We had a tough quarter, I think it was Q3 right Kristian, yes, Q3 of 2020 and a monster quarter in Q4 and it was like a snapback to where we work. So, even if there’s a slowdown, we might get that effect, but that’s the wildcard. Otherwise nothing in the industry is happening that would in my view change the trend.

In terms of some of the critical functionality, yes, generative design is important. The ANSYS simulation is important. But the thing I think is really carrying the day is this concept that our guys call model-based enterprise. And what that really means is, companies are trying to make 2D drawings go away. In the world of engineering, there has been forever a really messed up process, where engineers create 3D models to really conceptualize the parts and how they fit together and to simulate them with technologies like ANSYS and everything is done in 3D. And then the very last step is, they convert that all to 2D drawings. They dumb it down and leave a lot of information behind and the drawings get sent out to the supply chain and to the factory and everything else.

And then, for example, at suppliers they get these drawings and they turn around and remodel them in 3D. And the factory gets the data and they might have to remodel, so they can generate tool paths off it and whatnot. So the industry has said for a long time, we shouldn’t need drawings, but we need to figure out how to get different processes that aren’t so dependent on them, because all the procurement processes, the supplier collaboration processes are based on drawings and red lines and so forth. So what’s happening now is many, many companies are saying, okay, this is it. That drawing process has to go now. What we have to do is model it in 3D. It has to be 3D — annotated 3D models go out to suppliers, annotated 3D models go down in the manufacturing process, annotated 3D models end up in the service process, there’s not going to be any more drawings.

Now that requires a lot more adoption of CAD, because suddenly now a lot more people need a CAD suite rather than an Acrobat viewer, PDF suite, if you will. We’re not just talking about viewing a PDF file; we’re now talking about interacting directly with the 3D data. So I think that’s a driver for the whole industry, but I certainly can tell you here at PTC, it’s a driver. Many more suites of CAD software are sold when a company decides to move away from drawings. And on their side, they can shut a whole department down. And it’s a department that not only leaks value, it actually actively destroys it by dumbing data down that then has to be smartened back up by somebody else downstream. So I think that’s a big factor this model-based enterprise stuff.

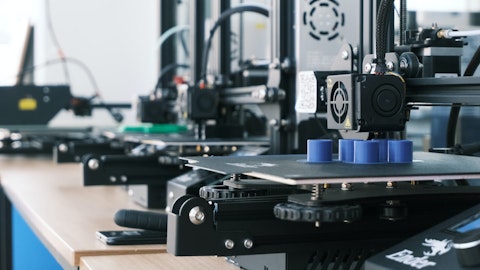

That’s the whole capability around annotated 3D models and whatnot and viewing technologies and markup and collaboration. But certainly, generative design and simulation, 3D printing, additive manufacturing, those are all quite interesting as well. Now, finally, on your last question about the smallest R&D budget. I’m an R&D guy, so I’m not going to lose and we have not been losing the product battle. We’ve actually been winning the product battle. And I think what it is, is just, R&D is not about body count, it’s about strategy, it’s about project selection, it’s about execution. Some of our larger competitors spend a lot of time and energy developing nonsensical products; products that don’t work; don’t make any sense. Autodesk was famous for that for many years.

But some of our French and German competitors, French in particular, they’ve developed a lot of 3D experience, blah, blah, blah, that these are products that actually mean anything to anybody, but there’s engineers working on them. So, I think, at PTC, we’re just much more serious, much more focused. We prioritize what we do. We execute it well. We don’t get in too many rework loops. We’re just very efficient. And I think that’s the winning recipe. Throwing bodies at R&D is not a winning strategy. Executing a good strategy efficiently is what it takes to win and we’re doing fine in the product front. You know this. Our products are very strong and, if anything, getting stronger despite the fact that we spend less in R&D. And then, finally, one last comment.

It’s not like we don’t spend much on R&D. Creo has 500 engineers working on it. Windchill has 500 engineers working on it. If you have 1000 engineers on it you just have more people tripping all over each other. So I think also I don’t want you to think we don’t spend much. We’re not quite as extravagant as other people, but we’re executing very, very well within what is a substantial spend envelope.

Jay Vleeschhouwer: Thank you very much, Jim.

Jim Heppelmann: Thanks.

Operator: Your next question comes from the line of Adam Borg from Stifel. Your line is open.

Adam Borg: Awesome. Thanks so much for taking the question. Maybe just two quick ones. Just first, Jim, just on the incremental softness you noted on the macro, it doesn’t sound like things gotten any softer in the month of January. And of course, January is a smaller month to begin with, but just any commentary there on how demand trends have started so far in the month of January. And maybe just as a follow-up on ServiceMax, obviously it seems really compelling, just curious now that the acquisition closed, how early customer feedback is from both customers and prospects? Thanks so much.

Jim Heppelmann: Yeah. So on the first question, how’s Q2 looking, at the start of the quarter here, we’re more or less still at the start of the quarter because if you look at our quarter, a majority of our business is done in the third month of the quarter. So it’s very difficult in the first month to really understand how things are trending. I mean we’re starting the quarter with a decent pipeline. We’re starting the quarter with a decent forecast. The real question will be in the last week or two of the quarter, are we able to close these deals or do they slide. If they slide, bookings will be soft again. If they close, actually we’ll have a pretty stellar bookings quarter based on how things are forecasted at the moment or maybe we’ll end up somewhere in between. What was the second question? Sorry, I didn’t write it down.

Adam Borg: No worries, just on ServiceMax.

Jim Heppelmann: ServiceMax, yes. So ServiceMax, I mean you see I’m very excited about it. You can probably sense that through the call here. That’s because customers are very excited about it. I mean, we had a thesis of what this was going to mean. We’ve gotten into it. We found how many customers had independently purchased software from both of us, but also how many customers ServiceMax has that looked like PTC customers and how many customers PTC have that look like they should be ServiceMax customers. And a lot of common customers immediately contacted me, immediately contacted Neil and said “Hey can we get together? Can you fly out and see us? Can we come visit you? We want to hear this story.” To be honest, we’re pushing back a little bit on them saying “Could you just give us a little bit of time to figure out the details?” So we’re really targeting that for LiveWorx.

I mean obviously, we’ll talk to a lot of customers before LiveWorx, but that will be kind of the grand unveiling of that sort of infinity concept that I had on that slide. And I think it will be very exciting. I think there’ll be many, many excited customers.

Matt Shimao: Rob, we have time for one final question today.

Operator: Your next question comes from the line of Jason Celino from KeyBanc Capital Markets. Your line is open.

Jason Celino: Hey, Jim, hey, Kristian. Thanks for fitting me in. Maybe just a quick one. We’ve been hearing different customers and organizations trying to use PLM more within their organizations. When we think about the expansion, is it expanding to different departments and teams, or is it product development, just becoming a more critical role within an organization? I guess, how would you kind of quantify this secular dynamic?